Land Conservation Easements: Tax Avoidance or Evasion?

Question: I was going to look into a conservation easement (CE) for a client and noticed the IRS has focused heavily on compliance efforts for abusive syndicated transactions. Are there any legitimate conservation easement transactions, or is it best to stay away from this strategy until things calm down?

Answer: Sounds too good to be true, right? A $500,000 charitable tax deduction for a $100,000 land purchase in December. In your search for information, you may be scared off by the court cases and Department of Justice investigations of the promoters of syndication easements.

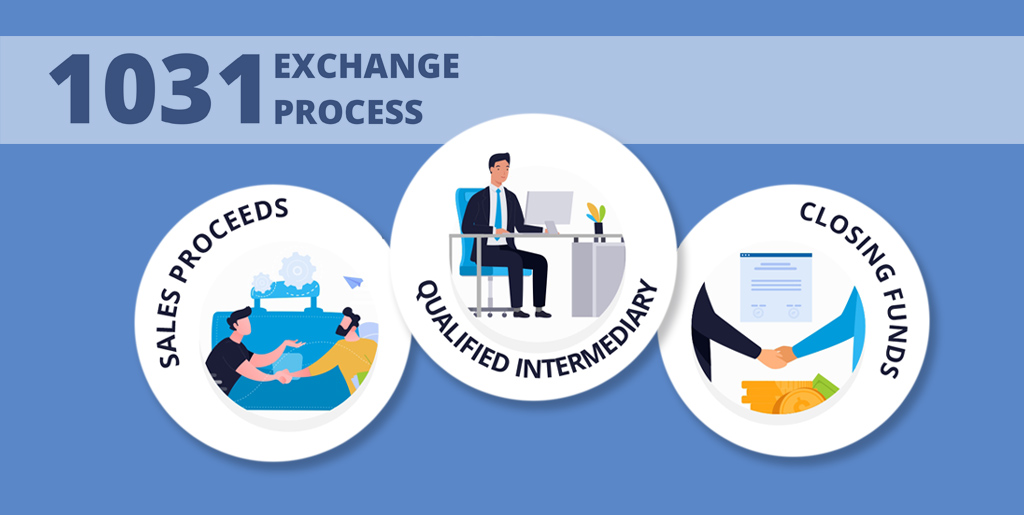

Syndication deals are partnerships that own land ideal for conservation and allow groups of investors to pool their money in the business, which typically will also include other activities beyond just the land ownership.

These deals have come under heavy scrutiny in the past few years as CEs became a listed transaction and more cases have wound their way through the court system. The IRS even announced a settlement program for syndicated conservation easements in mid-2020.

Click here to read the full answer.

Read More