At Around the Tax World, you can find out all about what’s going on in the wonderful, worldwide world of tax. Every month, we’ll feature a few mini-articles on what’s been going on in the world when it comes to tax, and fully available for viewing even if you don’t have a subscription.

If you wish to subscribe and gain access to all articles on the site, be sure to check out the benefits of doing so here!

Check out what’s happening all around the world of tax!

In The Headlines

- CVS Health could be making a revenue comeback in 2024. At the start of 2025, the pharmacy’s shares are up by more than 45%, outpacing competitor Walgreens. This comes after stocks dropped by over 40% at the end of 2024 as investors responded to lower-than-expected revenue. However, the company was already rebounding and saw sales of $97.71 billion for the fourth quarter. Insurers across the board have been struggling with unexpectedly high medical costs and dropping reimbursement rates for prescription drugs. Additionally, a higher number of Medicare Advantage patients have recently gotten medical procedures they delayed during the pandemic, increasing the number of healthcare benefit payouts. Medicare Advantage plan holders should prepare to see higher copays and premiums and fewer health benefits as insurers attempt to improve their profit margins.

- Could this be the beginning of the end for the Consumer Financial Protection Bureau? The Trump administration recently called for the CFPB to halt their work, which includes investigating fraud and other unfair or abusive business practices. Opponents of the agency believe the CFPB has overreached its authority, and some have questioned whether its very existence is unconstitutional. However, supporters of the CFPB are concerned about the lack of oversight of finance companies from mortgage lenders to payment apps while the agency’s operations are on hold. Some also worry that if other regulators step into the void left by the CFPB, businesses could face heavier or more confusing requirements. Putting the agency on pause leaves a number of cases in limbo, including a case accusing Capital One of cheating customers with high interest accounts, against Meta concerning advertisements for financial products, and suing Experian for mishandling customer complaints.

- Biotech stocks are yo-yoing after RFK is confirmed to head the Department of Health and Human Services. Robert F. Kennedy Jr. was recently sworn in as HHS secretary, causing investors to shift their plans in light of his expected policies. RFK’s skepticism toward vaccines caused BioNTech, Moderna, Novavax, and Pfizer stocks to drop after his confirmation. Meanwhile, stocks linked to psychedelics rose given the new secretary’s purported openness to the use of therapeutic psychedelics. As political shifts continue, analysts advise anticipating even more fluctuations for biotech stocks. For instance, Catalyst Pharmaceuticals, which is releasing treatments for rare diseases and diseases of the central nervous system, hit an all-time high last month before dropping below its competitors a week later. On the other hand, drug delivery expert Halozyme Therapeutics, cancer treatment specialist Exelixis, and immunodeficiency-focused ADMA Biologics all projected surprisingly high earnings, showing that some parts of the biotech world may rebound yet.

What's New In The Tax World?

Could $4.5 trillion in tax cuts be coming down the federal pipeline?

House Republicans’ new budget resolution would allow for aggressive tax cuts, increasing the debt ceiling by $4 trillion, and mandatory spending cuts of $2 trillion over the next decade. Republican legislators are using a process that would allow the budget to pass with a simple majority vote. Negotiations are expected to continue within the GOP conference, some advocating for more tax cuts and others pushing for more spending cuts.

Among the tax initiatives is a plan to extend the tax cuts introduced by Trump during his first presidential term. This includes a higher standard tax deduction, lower marginal income tax rates for most brackets, a cap on state and local tax deductions, a higher child tax credit, a deduction for pass-through business income, a higher alternative minimum tax exemption, and a larger estate tax exemption. Independent analyses suggest that a renewal of the 2017 tax cuts could add $4.8 trillion to the national debt over the next 10 years. When added to Trump’s plans to eliminate taxes on tips, overtime pay, and Social Security, the total cost is projected to land between $5 trillion and $11.2 trillion over the course of a decade.

These cost estimates could be a major roadblock for the bill. Republicans are counting on using budget reconciliation—a maneuver that bypasses Senate Democrats, but to do so, Senate rules restrict the bill from adding to the federal deficit beyond a 10-year window. Supporters of the bill say that the cost of extending the tax cuts will be offset by spending cuts, the elimination of clean energy tax incentives, and overall economic growth spurred on by the tax cuts themselves.

In addition to outlining policy priorities, the House budget resolution redirects the flow of federal spending and will likely result in cuts to social services, such as Medicaid. A number of House committees would be required to dramatically reduce spending, including $880 billion in cuts over the next decade from the Energy and Commerce Committee, $330 billion from the Education and Workforce Committee, $230 billion from the Agriculture Committee, and $10 billion from the Transportation and Infrastructure Committee. Spending in other areas would receive a boost—an additional $100 billion would be added to defense spending and $90 billion to the Homeland Security Department to fund Trump’s deportation plan.

State-By-State Updates

- A new Georgia bill could provide taxpayers with another special refund. Governor Brian Kemp proposed the tax refunds in late 2024, and if approved, this round of refunds would be similar to those issued in 2022 and 2023. Single filers would receive $250, heads-of-household would receive $350, and married couples filing jointly would receive $500. The previous rounds of rebates cost the state approximately $1.1 billion. Meanwhile, the state’s House Ways and Means Committee is also weighing a bill to reduce state income taxes. The governor successfully advocated for a reduction that took place at the start of 2025, dropping the flat income tax rate to 5.39%. If the new bill is approved, the income tax rate would be lowered to 4.99% over the next two years.

- Massachusetts makes strides in boosting the local film industry with $92.8 million in tax credits. In 2023, the state issued the largest film subsidy in a single year since before the pandemic, distributed between 250 productions. The tax credits cover 25% of the cost to make movies, television programs, or commercials in Massachusetts. These tax credits can be sold to banks, insurance companies, and other entities to boost funding for production companies. Supporters of the film tax credit say the incentive has created over 1,000 jobs that would not otherwise exist in the state and have suggested increasing the tax credits to become even more competitive. Opponents say the program costs more than it brings in state revenue and benefits Hollywood more than Massachusetts taxpayers.

- The Missouri House passes a bill that nixes income tax on long-term capital gains. Taxpayers may see a higher yield from assets held for more than a year if the new bill is approved by the Senate. Republicans and Democrats were evenly split on approving the tax cut, which would benefit the holders of stocks, land, and other assets but would cost the state $341 million in its first year alone. Advocates for the bill say eliminating this tax helps small business owners who are looking to sell assets as they draw closer to retirement. Others have their eye on eliminating the state income tax altogether and see this as a step in that direction. Opponents worry that without the revenue education and other state services will get cut, especially since public schools are already facing a shortfall and asking for more funding.

- Texas addresses rising property taxes with a new tax cut for homeowners. The state Senate unanimously approved a proposal to adjust the homestead exemption from $100,000 to $140,000, meaning that this amount of the value of a home cannot be taxed to pay for public schools. Since Texas does not have an income tax, the state relies on property taxes to pay for public schools, police, fire, and other public services. The change is especially notable since the average value of a home is below $140,000 in about half of Texas’ school districts. Lawmakers have been motivated to lower property taxes, which rose almost 30% for the average homeowner between 2010 to 2023. If the bill passes in the House, voters would be given the final say, since changing the homestead exemption requires an amendment to the state Constitution.

Tax Planning Tips

Have a home equity loan? Be clear on the tax deductions available to you. Homeowners can often borrow sums as large as six figures at lower interest rates than with personal loans or credit cards. Home equity loans also come with certain tax benefits—assuming you understand the rules. With a home equity loan, the interest paid can be deducted from your taxes. This means if you took out a $100,000 loan in 2024 and paid $10,000 in interest, that $10,000 could be tax-deductible. The key is that the loan must be used to buy, build, or substantially improve the taxpayer’s main home or second home. Keep in mind that a home can include a house, condo, cooperative, mobile home, house trailer, boat, or other property with sleeping, cooking, and toilet facilities. The IRS provides a guide for which types of renovations and repairs qualify and which do not. Taxpayers can also deduct interest paid on home equity lines of credit (HELOCs) if the funds are used for IRS-eligible projects.

Retirees can implement different tax strategies to lower their tax bill. Did you know that the tax savings tips that will work best for you may shift once you enter retirement? For instance, the standard deduction available is higher for taxpayers aged 65 and older. For 2024, you can add an extra $1,550 if you meet this age requirement. If you are also unmarried and not a surviving spouse, you can add another $1,950. You also see more tax advantages on retirement accounts as you age. Taxpayers aged 50 and older can put up to $30,500 in their 401(k) account, for instance. In 2025, this threshold will rise to $31,000. On top of that, taxpayers ages 60 to 63 receive a special catch-up contribution limit of $11,250 starting in 2025. 401(k) contributions lower your taxable income. Similarly, if you make contributions to a traditional individual retirement account (IRA), these are tax-deductible, and you are allowed a higher contribution amount after age 50.

NOT A MEMBER YET?

SUBSCRIBE TO GET ALL OF OUR

GREAT ARTICLES AND RESOURCES!

CURRENT EDITION

Renewable Energy Tax Credits: An Opportunity to Sustainably Optimize Taxes

Investment Tax Credits (“ITCs”) and Production Tax Credits (“PTCs”, and together with ITCs, “RETCs”) have existed for decades and reflect the U.S. government’s commitment to incentivizing clean energy solutions in industry and commerce. The availability of RETCs was most recently extended by the Inflation Reduction Act of 2022 (“IRA”), which fundamentally transformed policy in this space by tying such credits’ expiration to the U.S. reaching certain targets for greenhouse gas reductions. While the recent change in Executive Branch leadership casts doubt over the longevity of RETCs, a full repeal seems unlikely given the scope and scale of domestic projects which utilize and benefit from such credits. This article discusses how RETCs may benefit both buyers and sellers in an increasingly uncertain environment.

DeFi-nitely Confusing: Final Regulations for Digital Asset DeFi Brokers

Well, at least the treasury department is true to form. They have ruined yet another international trip for me, which is the third time if you’re keeping track at home. This time it was a weekend trip to Toronto, which coming from upstate New York is technically “international,” yet somehow substantially closer to home than New York City. Late afternoon on the Friday before New Year’s Eve, the Treasury released another 115 pages of Digital Asset Regulations, along with a 13 page notice for good measure. As we’ve discussed previously on TOTTB, the last set of regs punted on a number of more complex crypto issues. This most recent release is all about one of those issues, Decentralized Finance, better known as “DeFi.”

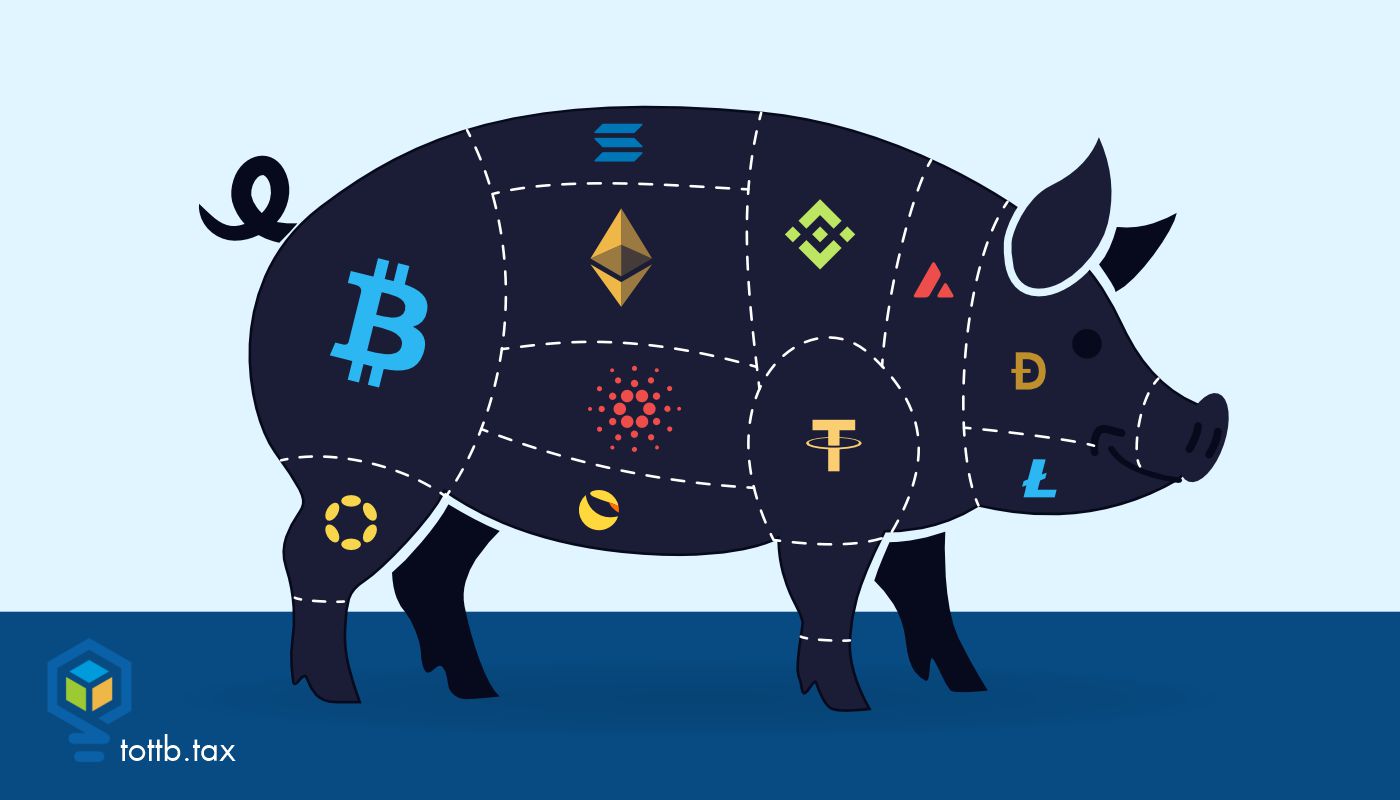

Pig Butchering Can Slaughter Your Clients’ Finances

People use the online space to look for love, make business and financial decisions. And all of these decisions can have serious tax implications. That is why as trusted financial and tax advisors, it is important for us to be aware so we can help protect our clients. In 2024, the Federal Trade Commission released a report showing consumers reported losing $4.6 billion in investment scams. That’s only the amount reported, so our clients are at risk if they are online making financial decisions. Today, let’s look at a newer player in the online investment scam arena: pig butchering. If you’re like me, you’re probably thinking “what in the world does this have to do with taxes?” Unfortunately, everything. It leads to taxpayers receiving tax bills for money they withdrew but lost as victims of theft.