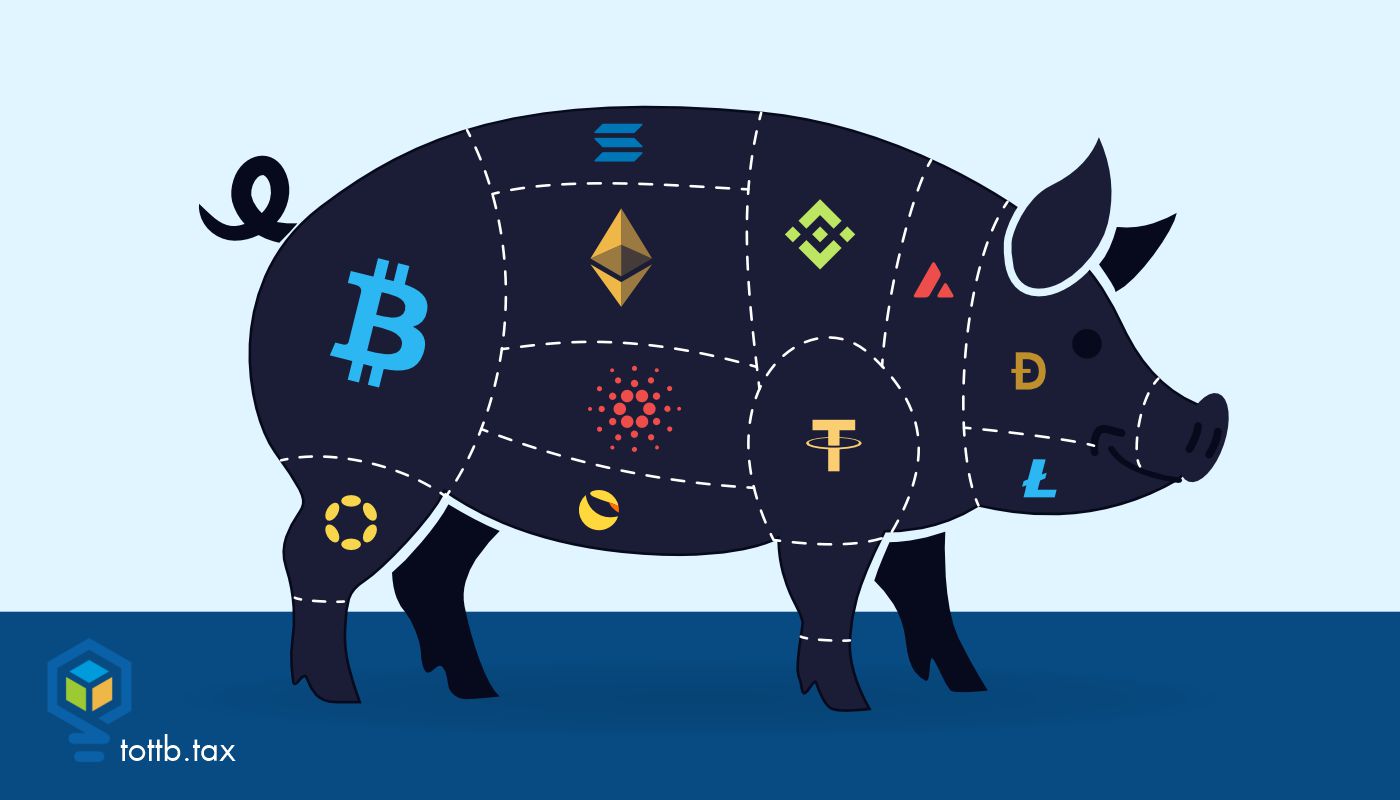

People use the online space to look for love, make business and financial decisions. And all of these decisions can have serious tax implications. That is why as trusted financial and tax advisors, it is important for us to be aware so we can help protect our clients. In 2024, the Federal Trade Commission released a report showing consumers reported losing $4.6 billion in investment scams. That's only the amount reported, so our clients are at risk if they are online making financial decisions. Today, let's look at a newer player in the online investment scam arena: pig butchering. If you're like me, you're probably thinking “what in the world does this have to do with taxes?” Unfortunately, everything. It leads to taxpayers receiving tax bills for money they withdrew but lost as victims of theft.

Summertime Marketing in Your Tax & Accounting Firm

Tax season is prosperous, summer is dry until extension season. Do you find yourself in that cycle? Clients are “easy” to get during tax season when taxes are top of mind. Then the direct deposits go dry by June, and you are looking for what’s next. Stop the search, you don’t have to add another service. You need better marketing to highlight the service that you offer and specialize in. This will allow you to have a predictable client pipeline. You can do tax preparation, planning, and or representation all year long.