WE PUBLISH TAX STRATEGIES FOR…

FEATURED CONTENT

When TikTok Tax Hacks Backfire: Helping Clients Misled by Social Media Scams

Jessica, a self-employed consultant, was thrilled when she found a viral TikTok video promising a “little-known” tax trick. The video claimed she could get a huge refund by claiming a special Fuel Tax Credit and even writing off her family’s beach vacation as a business expense. Following the advice, Jessica filed an amended tax return and waited eagerly for a windfall. A few months later, instead of a refund check, Jessica received a stern IRS notice. Her so-called credits were disallowed, her refund was denied, and she now faced penalties. Jessica isn’t alone. Every tax season, well-intentioned taxpayers get lured by false tax advice on social media, only to end up in trouble. As tax professionals, we often meet panicked clients like Jessica who need our help to untangle the mess.

Read MoreCURRENT EDITION

This Is The Only Other Year-End Tax Tip Guide You Need

So as I did last year, I have reviewed a multitude of year-end tax tips articles. One of them is a real standout that you should be sure to check out. If you missed it, you should definitely roll back to the November 15 edition and go over Dominique Molina’s piece, which focuses on what you need to do sooner rather than later in response to OBBBA. It provides more detailed, relevant, actionable advice that you won’t see anywhere else than any of the multitude of pieces I have reviewed. As for the rest, I will give you a basic rundown of what I call the SOSO (same old, same old) and a few suggestions that stand out as different that I will get into a little more along with some thoughts of my own.

The Corporate Vault: How to Use a C Corporation to Stockpile Cash for the Future

When most people think about saving for the future, their minds jump to retirement accounts—401(k)s, IRAs, maybe even defined benefit plans. But business owners have another option that often goes overlooked: using a C corporation as a strategic savings vehicle. By leveraging the flat 21% corporate tax rate, smart income shifting, and careful timing of distributions, business owners can “stockpile” cash inside a corporation, building wealth for future use without the red tape of traditional retirement plans. Want to see how top tax strategists legally use C corporations as private retirement vaults while avoiding double taxation and IRS scrutiny? Continue reading to learn the blueprint.

Explore Our Free Articles

Get a taste of our comprehensive tax planning insights with four featured articles, free for everyone.

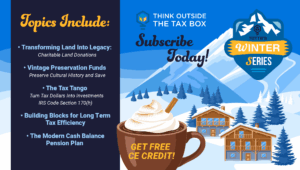

2025 Winter Education Series Event Calendar

Think Outside the Tax Box proudly presents the 2025 Winter Education Series! This October through December, we are bringing our loyal subscribers five webinars featuring some of the brightest minds in tax. Each high quality webinar is filled with engaging content, actionable insights for your clients, and they all come

Charitable Impacts of the One Big Beautiful Bill Act

For charitable-minded taxpayers, several provisions in the One Big Beautiful Bill Act (OB3 Act) will impact the tax reduction associated with their charitable giving starting next year in 2026. In one case, the change increases the deductible amount, but all other changes surprisingly reduce the value of charitable contribution deductions.

The End of the Green Road? The One Big Beautiful Bill and Energy Credits

Just when many believed green tax incentives were firmly established, the One Big Beautiful Bill (OB3), formally designated as Public Law 119-21 and enacted on July 4, 2025, delivers a sudden and sweeping rollback of key energy tax credits. Affecting everything from electric vehicles to rooftop solar, OB3 significantly alters

Editor’s Pick: Tax Planner Faces Malpractice Claims Over Decades-Old Tax Advice—What Went Wrong?

In a case that every tax professional should take note of, the prominent law firm Sidley Austin LLP finds itself defending against claims that it provided faulty tax advice over two decades ago, leading to massive IRS liabilities for a family. The plaintiffs, the Cáceres family, are seeking to recover

Exclusive Webinars for Our Subscribers

As an annual subscriber, you gain complimentary access to our series of expert-led webinars. Each session is designed to provide you with insights, skills, and knowledge to excel in your field. Discover what’s coming up and secure your spot today.

Learn how to interpret and document your tax planning research findings. Learn what you can rely upon, and how to protect your recommendations.

May 23, 2024

Learn what injured spouse relief is and how it is different from innocent spouse relief, how to request this relief and help your client through that process.

September 5th, 2024

These educational webinars are included in the Basic or Professional subscription! Subscribe today!

June 6th, 2024

Don't Miss Our Next Webinar

Mark your calendar and stay ahead of the latest tax planning strategies and regulations

Webinar

TBD

Featured Authors

Amber Gray-Fenner is an Enrolled Agent and tax practitioner specializing in tax returns, planning, and representation for individuals and small businesses. She owns Tax Therapy, LLC in Albuquerque, New Mexico.

Matt Metras, EA, owns MDM Financial Services in NY, specializing in bookkeeping and taxation for cryptocurrency clients. He’s an educator on cryptocurrency taxation and actively engages in community advocacy.

Jeff Stimpson, has been a tax and finance writer for 25 years. Hee contributes to publications like Accounting Today and Financial Advisor. His other credits include sales tax, technology, and practice management, residing in New York.

Annette Nellen is a professor and tax program director at San José State University, with extensive involvement in tax organizations and a focus on tax policy, cryptocurrency, and education.

Peter J Reilly graduated from the College of the Holy Cross, worked in CPA firms like Joseph B Cohan and Associates and CCR LLP, and now runs a tax practice while writing for Forbes.com.

Thomas Gorczynski, EA USTCP CTP, is a tax expert known for speaking and educating on federal tax law. He’s editor-in-chief of EA Journal, co-author of the PassKey Learning Systems EA Review Series, and runs a tax practice in Phoenix, Arizona.

Hear From Our Satisfied Users

Quotes from users who have benefited from Tax Law Pro, highlighting how it has helped them in their tax planning and compliance efforts.

SIMPLIFIED TAX STRATEGIES &

PRACTICAL IMPLEMENTATION

Think Outside the Tax Box provides tax reduction strategies along with practical

implementation advice in order to reduce your clients’ federal tax bill with ease.