WE PUBLISH TAX STRATEGIES FOR…

FEATURED CONTENT

Kadau v. Commissioner and the Line Between Effective and Broken Captives

Captive insurance remains one of the most closely examined tax planning strategies in use today, not because it is inherently flawed, but because small missteps can carry outsized consequences. Many taxpayers assume that careful formation and proper documentation are enough to protect the intended tax outcome. A recent Tax Court decision, Kadau v. Commissioner, serves as a reminder that those assumptions deserve closer scrutiny. The court’s analysis did not hinge on whether captive insurance can work, but on how a specific arrangement actually functioned in practice. For tax professionals advising clients who rely on micro-captives, the case raises important questions about where structures tend to break down, why some arrangements attract IRS attention while others do not, and what really separates a defensible captive from one that invites challenge.

Read MoreCURRENT EDITION

Tackling Taxes On an Inherited HSA

The Health Savings Account (HSA) is a first line of defense tax strategy. Contributions are deductible and earnings are tax-free if used for qualified medical expenses. There are numerous features to the HSA that secure maximum tax benefits. Structured properly, an HSA can provide serious tax-free money to beneficiaries as well as the account holder. Before we review the implications of inheriting an HSA, let’s review some of the powerful features an HSA has that increases the value of the account.

Kadau v. Commissioner and the Line Between Effective and Broken Captives

Captive insurance remains one of the most closely examined tax planning strategies in use today, not because it is inherently flawed, but because small missteps can carry outsized consequences. Many taxpayers assume that careful formation and proper documentation are enough to protect the intended tax outcome. A recent Tax Court decision, Kadau v. Commissioner, serves as a reminder that those assumptions deserve closer scrutiny. The court’s analysis did not hinge on whether captive insurance can work, but on how a specific arrangement actually functioned in practice. For tax professionals advising clients who rely on micro-captives, the case raises important questions about where structures tend to break down, why some arrangements attract IRS attention while others do not, and what really separates a defensible captive from one that invites challenge.

Explore Our Free Articles

Get a taste of our comprehensive tax planning insights with four featured articles, free for everyone.

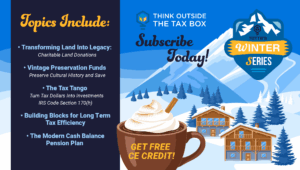

2025 Winter Education Series Event Calendar

Think Outside the Tax Box proudly presents the 2025 Winter Education Series! This October through December, we are bringing our loyal subscribers five webinars featuring some of the brightest minds in tax. Each high quality webinar is filled with engaging content, actionable insights for your clients, and they all come

Charitable Impacts of the One Big Beautiful Bill Act

For charitable-minded taxpayers, several provisions in the One Big Beautiful Bill Act (OB3 Act) will impact the tax reduction associated with their charitable giving starting next year in 2026. In one case, the change increases the deductible amount, but all other changes surprisingly reduce the value of charitable contribution deductions.

The End of the Green Road? The One Big Beautiful Bill and Energy Credits

Just when many believed green tax incentives were firmly established, the One Big Beautiful Bill (OB3), formally designated as Public Law 119-21 and enacted on July 4, 2025, delivers a sudden and sweeping rollback of key energy tax credits. Affecting everything from electric vehicles to rooftop solar, OB3 significantly alters

Editor’s Pick: Tax Planner Faces Malpractice Claims Over Decades-Old Tax Advice—What Went Wrong?

In a case that every tax professional should take note of, the prominent law firm Sidley Austin LLP finds itself defending against claims that it provided faulty tax advice over two decades ago, leading to massive IRS liabilities for a family. The plaintiffs, the Cáceres family, are seeking to recover

Exclusive Webinars for Our Subscribers

As an annual subscriber, you gain complimentary access to our series of expert-led webinars. Each session is designed to provide you with insights, skills, and knowledge to excel in your field. Discover what’s coming up and secure your spot today.

Learn how to interpret and document your tax planning research findings. Learn what you can rely upon, and how to protect your recommendations.

May 23, 2024

Learn what injured spouse relief is and how it is different from innocent spouse relief, how to request this relief and help your client through that process.

September 5th, 2024

These educational webinars are included in the Basic or Professional subscription! Subscribe today!

June 6th, 2024

Don't Miss Our Next Webinar

Mark your calendar and stay ahead of the latest tax planning strategies and regulations

Webinar

TBD

Featured Authors

Amber Gray-Fenner is an Enrolled Agent and tax practitioner specializing in tax returns, planning, and representation for individuals and small businesses. She owns Tax Therapy, LLC in Albuquerque, New Mexico.

Matt Metras, EA, owns MDM Financial Services in NY, specializing in bookkeeping and taxation for cryptocurrency clients. He’s an educator on cryptocurrency taxation and actively engages in community advocacy.

Jeff Stimpson, has been a tax and finance writer for 25 years. Hee contributes to publications like Accounting Today and Financial Advisor. His other credits include sales tax, technology, and practice management, residing in New York.

Annette Nellen is a professor and tax program director at San José State University, with extensive involvement in tax organizations and a focus on tax policy, cryptocurrency, and education.

Peter J Reilly graduated from the College of the Holy Cross, worked in CPA firms like Joseph B Cohan and Associates and CCR LLP, and now runs a tax practice while writing for Forbes.com.

Thomas Gorczynski, EA USTCP CTP, is a tax expert known for speaking and educating on federal tax law. He’s editor-in-chief of EA Journal, co-author of the PassKey Learning Systems EA Review Series, and runs a tax practice in Phoenix, Arizona.

Hear From Our Satisfied Users

Quotes from users who have benefited from Tax Law Pro, highlighting how it has helped them in their tax planning and compliance efforts.

SIMPLIFIED TAX STRATEGIES &

PRACTICAL IMPLEMENTATION

Think Outside the Tax Box provides tax reduction strategies along with practical

implementation advice in order to reduce your clients’ federal tax bill with ease.