LOOKING FOR LEGAL WAYS

TO REDUCE TAX?

New tax reduction strategies carefully explained and exhaustively researched every two weeks. Receive breaking news updates on tax law changes. Members only monthly AMA with TOTTB.tax.

WE PUBLISH TAX STRATEGIES FOR…

FEATURED CONTENT

How to Differentiate Yourself as an Accountant

In a highly competitive business landscape, even we accountants face the challenge of setting ourselves apart from our peers. The accounting profession has changed significantly in recent years, with technological advancements, changing regulations, and shifting client expectations. To thrive in this environment, as accountants, we must possess strong technical skills and differentiate ourselves by offering unique value to our clients. The hardest part of establishing our unique value is objectively looking at our accounting journey and pinpointing our most significant achievements.

Read MoreCURRENT EDITION

Renewable Energy Tax Credits: An Opportunity to Sustainably Optimize Taxes

Investment Tax Credits (“ITCs”) and Production Tax Credits (“PTCs”, and together with ITCs, “RETCs”) have existed for decades and reflect the U.S. government’s commitment to incentivizing clean energy solutions in industry and commerce. The availability of RETCs was most recently extended by the Inflation Reduction Act of 2022 (“IRA”), which fundamentally transformed policy in this space by tying such credits’ expiration to the U.S. reaching certain targets for greenhouse gas reductions. While the recent change in Executive Branch leadership casts doubt over the longevity of RETCs, a full repeal seems unlikely given the scope and scale of domestic projects which utilize and benefit from such credits. This article discusses how RETCs may benefit both buyers and sellers in an increasingly uncertain environment.

DeFi-nitely Confusing: Final Regulations for Digital Asset DeFi Brokers

Well, at least the treasury department is true to form. They have ruined yet another international trip for me, which is the third time if you’re keeping track at home. This time it was a weekend trip to Toronto, which coming from upstate New York is technically “international,” yet somehow substantially closer to home than New York City. Late afternoon on the Friday before New Year’s Eve, the Treasury released another 115 pages of Digital Asset Regulations, along with a 13 page notice for good measure. As we’ve discussed previously on TOTTB, the last set of regs punted on a number of more complex crypto issues. This most recent release is all about one of those issues, Decentralized Finance, better known as “DeFi.”

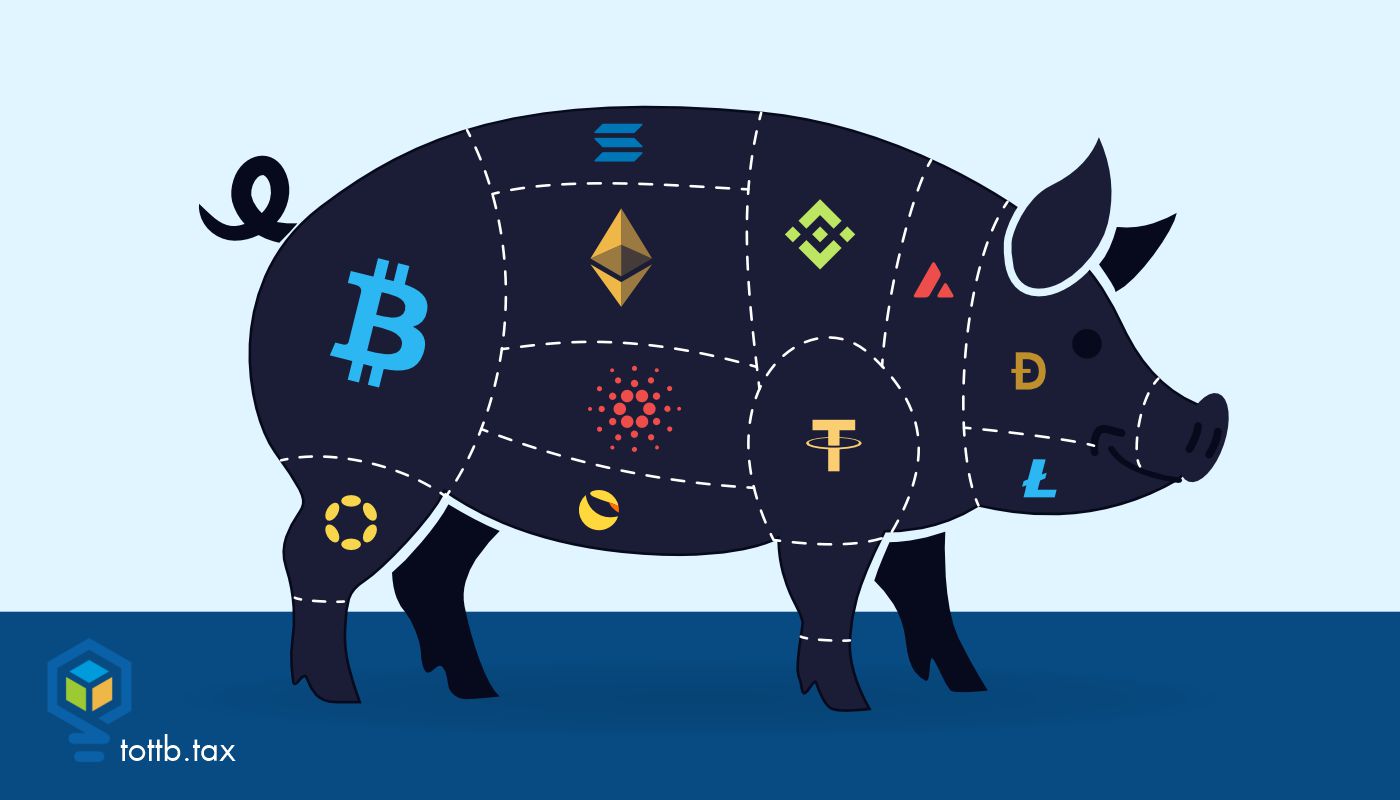

Pig Butchering Can Slaughter Your Clients’ Finances

People use the online space to look for love, make business and financial decisions. And all of these decisions can have serious tax implications. That is why as trusted financial and tax advisors, it is important for us to be aware so we can help protect our clients. In 2024, the Federal Trade Commission released a report showing consumers reported losing $4.6 billion in investment scams. That’s only the amount reported, so our clients are at risk if they are online making financial decisions. Today, let’s look at a newer player in the online investment scam arena: pig butchering. If you’re like me, you’re probably thinking “what in the world does this have to do with taxes?” Unfortunately, everything. It leads to taxpayers receiving tax bills for money they withdrew but lost as victims of theft.

SIMPLIFIED TAX STRATEGIES &

PRACTICAL IMPLEMENTATION

Think Outside the Tax Box provides tax reduction strategies along with practical

implementation advice in order to reduce your clients’ federal tax bill with ease.