CURRENT EDITION

Contracts, Signing Bonuses, and the Substantial Presence Test

In tighter job markets, recruits are often offered signing bonuses (and sometimes moving expenses) to join a firm. Sometimes construction workers temporarily relocate to jobs in other states while they are employed by the company that hired them in their home state. This article reviews some of the foundational tax concepts to consider when evaluating sourcing of income for state tax purposes.

READ MORETime for Year-End Tax Planning

This year is far from over for tax planning – for some moves, you have even longer – but now’s the time to start looking and acting on your tax tactics given your circumstances and the 2023 you’ve had so far. What you do or don’t do now could save or cost you next April.

Read MoreAn Alphabet Soup of Confusion: LLCs, BOI, and UPL

By now I hope that all tax professionals have heard of the FinCEN requirement for certain entities to report beneficial ownership information starting in 2024. The requirement is causing confusion because tax and accounting professionals feel that this could be an opportunity to either add value to an existing engagement, could be a new revenue stream, or could be a huge potential for liability. What follows is a brief review of the law and the requirements, an analysis of the main issues, and some recommendations for practitioners wondering how to help their clients while limiting their professional liability.

Read MoreTAX COURT ROUNDUP – NOVEMBER 2023

A very mixed bag this month: IRS shifting ground on the eve of trial, plenty of discovery, loyalty programs, the end of the road for meaningful Section 6751(b) supervisory approval, and arrival of a new Special Trial Judge. And, as always, a lot of questions.

Read MoreElectronic Commerce Creates Confusing Sales Tax Obligations

Any company engaged in e-commerce, i.e., selling online, knows that the ability to reach buyers and customers remotely can juice the bottom line. State and local tax jurisdictions around the country know that, too, especially the bottom line of their sales tax coffers. Now every state with a statewide sales tax has a threshold past which remote sellers must collect and remit state sales tax. Failure to do so can incur big penalties, or worse, and there’s a lot to know based on where and what you sell online.

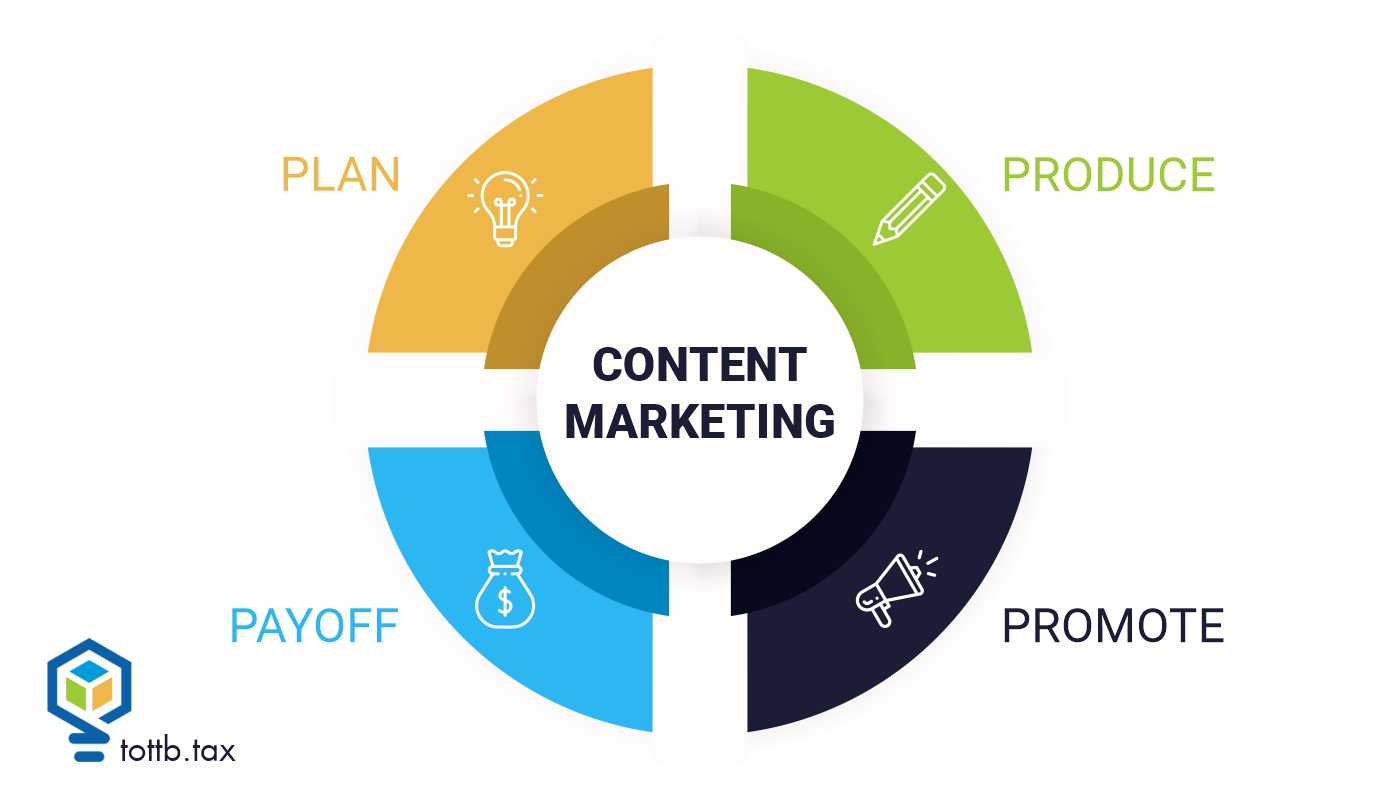

Read MoreContent Marketing for Accountants: Creating Valuable and Engaging Content

If you read my article Building a Strong Personal Brand as an Accountant: Strategies for Success you’d have learned about how I started my entrepreneurial journey in 2018, knowing absolutely nothing about marketing. I was one of those CFOs who would need to understand why a company has to spend more money on marketing; however, I did understand that having a robust online presence was necessary for a new digital age. Little did I know that marketing is senior to any other activity in a business.

Read MoreSome Harsh Lessons on Being Late from the Tax Court

Penalties for procrastination in tax matters can be somewhat harsh. Judge Albert Lauber of the United States Tax Court gave us some lessons on the topic earlier this year. The “strategy” of over withholding so that you can file your return whenever the spirit moves you rather than by the due date has a serious downside. The statute of limitations will not work in your favor, but it will work against you. It is a little like you are playing in a chess tournament and you and your opponent are staring at the board. Your clock is ticking and theirs is not.

Read MoreCan You Write Off Your Vacation on Your Taxes?

I saw a meme that said, “accountants go on vacation just so they can work from another location.” This might be true. So maybe, just maybe you can write your vacation off on your taxes. But on a serious note, this is a question that taxpayers have. “Can I write off my vacation on my taxes?” I hate to blame everything on the internet but...it is a dangerous place for taxpayers. There is an infamous Tik Tok video turned reel that has found its way into my DMs and e-mail inbox several times. I’m often amused by the bad tax advice that goes viral online. The comments tend to make me giggle or give me cause for concern. This particular video gave me more cause for concern. The main reason it did this is because of the amount of tax professionals that shared in agreement. I’m all for advertising on social media but often we must be careful as tax professionals. We have certain ethical obligations that unfortunately do not apply to other industries. We do not want to mislead taxpayers for “likes” or potentially going viral. Let me get to the details of the video. A tax professional whose credentials I won’t mention, was sharing how taxpayers can use their entire family vacation as a write off on their Schedule C. Rightfully so, this made taxpayer’s ears perk up. Why not kill two birds with one stone, right? What should not have happened was tax professionals sharing the video with filling in the blanks. I know you would never do that, and that’s why you’re here. To find out what parts of travel your client can write off on their taxes. So, let’s look at what constitutes something being a business expense. Then we’ll look at the due diligence you should take to make sure their travel and meal expenses are legitimate.

Read MoreWhat’s at Stake? It’s Not a Loaf of Bread

The IRS loves to issue cryptocurrency guidance when it’s the most inconvenient for me personally. I’m not sure how they accessed my calendar, but it certainly feels like this one was intentional. I was at a tax conference over the summer to teach an introduction to crypto class immediately after lunch. I had just finished eating when my phone started blowing up. The IRS published a new Revenue Ruling on Staking, 45 minutes before I was to teach about it. I read the six-page document, tried to digest it, and considered how I needed to adapt my material on the fly. Another frequent (but not to be named) Tax Box contributor present at the conference teased me about the situation I found myself in. The class went fine, though, because even with a surprise ruling, the IRS didn’t really say anything surprising. In typical IRS fashion, it also created more questions than it answered.

Read MoreNOT A MEMBER YET?

SUBSCRIBE TO GET ALL OF OUR

GREAT ARTICLES AND RESOURCES!

CURRENT EDITION

Contracts, Signing Bonuses, and the Substantial Presence Test

In tighter job markets, recruits are often offered signing bonuses (and sometimes moving expenses) to join a firm. Sometimes construction workers temporarily relocate to jobs in other states while they are employed by the company that hired them in their home state. This article reviews some of the foundational tax concepts to consider when evaluating sourcing of income for state tax purposes.

Help Clients Rebuild Tax Records After Disaster

Tax pros help clients with a lot of catastrophes: wrangles with tax authorities, paltry nest eggs, more wrangles with tax authorities. More frequently, your clients might face a more tangible and cinematic disaster. These days, there’s always a storm comin’. Swept away in that destruction, for many people, are physical tax and financial records. A few precautions could have prevented such loss and made life at least a bit easier for victims. Here’s how to help clients head off trouble – and recover after it hits.

George M. Cohan’s Tax Triumph: The Rise and Erosion of the Cohan Rule

The Cohan rule is named for George M. Cohan. George Michael Cohan (1878 – 1942) was a theatrical producer. In the decade before World War I, he was called the “man who owned Broadway” and is considered the father of American musical comedy. In 1940 he was awarded the Congressional Gold Medal for his contribution to morale during World War I with his songs “You’re a Grand Old Flag” and “Over There,” the first time the medal was awarded to someone in an artistic field. But his most enduring legacy may be the tax rule that shared its name.