CURRENT EDITION

The Benefits Your Military Veteran Clients Aren’t Using (And Why That’s a Planning Problem)

Why aren’t more veterans using the benefits they’ve earned? Part of the problem is awareness, and part of it is discomfort (for both veterans and advisors). After all, veteran benefits are rooted in service-connected health and trauma, placing them in a category that often feels more personal than financial. That alone can deter veterans from discussing their disability compensation and keep advisors from broaching the subject altogether. The result is financial plans that look optimized on paper but are built on incomplete assumptions and missed opportunities – opportunities that have been more than earned.

READ MORE“AI Inside” – What Does that Even Mean?

Remember back in the day when having your tax and accounting software in the "Cloud" was the newest, coolest thing? Even if it took us 10 years to realize that the "cloud" just meant someone's server somewhere else? Similarly, have you noticed that our tax and accounting products have a sprinkling of AI now? And if they don't, they're talking about how they'll be AI-ing soon? (And if they're not talking about it, do we even want them in our toolbox?) Let's chat about what it means to have "AI Inside", especially with the rise of tools like ChatGPT and Bard. The "AI Inside" label is becoming ubiquitous but can mean many things, so let's discuss. I'd hate for you to get excited about an AI feature only to discover that you can access it via one of the widely available Generative AI (GenAI) tools (ChatGPT, BingChat, Bard, Claude, etc.). While this new technology has fundamentally shifted everything, what does it mean for us as tax professionals? On this journey of exploring what "AI Inside" really means, we're going to discuss what's going on under the hood. We'll also dive into why creating a fully functional "TaxGPT" is challenging right now. (Notice I said "right now"). Finally, we can look at what "AI Inside" tools would be handy, even if you CAN get that functionality out of the regular ol' GenAI applications. In the end, you'll know whether to be impressed or pass. And, even more importantly, you'll know whether to spend the extra money on those tools.

Read MorePrepare For the Day When You Don’t Have More Work Than You Know What To Do With

In the last few months, I have been getting "seems like old times" feeling as interest rates rise. They remain laughably low by the standards of my early days in the business. I can remember prime being 20%. And then there are all these issues with office rentals thanks to the aftermath of the plague. One of the nice things about a career in accounting is that while you are affected by business cycles the need for our work is somewhat continuous. I’m thinking that now might be a good time to get ahead of the curve a little and study up on a Code Section that may be coming up a lot more – Code Section 108 – Income from discharge of indebtedness. Fortunately, a recent Tax Court opinion in the case of Michael G. and Julie A. Parker can provide us with a lesson in some of the important principles in this area.

Read MoreMinister’s Housing Allowance

There are tax perks to filing a tax return as an ordained minister. But some of the things you’ve heard in the pool of public opinion are false, while others have a hint of truth. For example, pastors and ministers do indeed pay income taxes. Churches, on the other hand, do not but that’s a different article for a different newsletter. If you are serving members of the clergy, it is important to understand these perks. One that I see messed up the most is the housing allowance. The IRS allows ordained ministers to exclude their housing allowance from taxable income. That is if they meet certain other criteria. The complete amount the church has deemed as a housing allowance is not always the amount that the IRS allows. Even with that, the excludable amount is only from income taxes, not all tax. Ministers also have special rules and a potential exemption when it comes to social security and Medicare taxes. This is where I see many well-meaning taxpayers and even tax professionals messing up. But that will not be you or your client. We are going to look at what the minister’s housing allowance is according to the IRS. Then we will look at who qualifies for it, and how to calculate it.

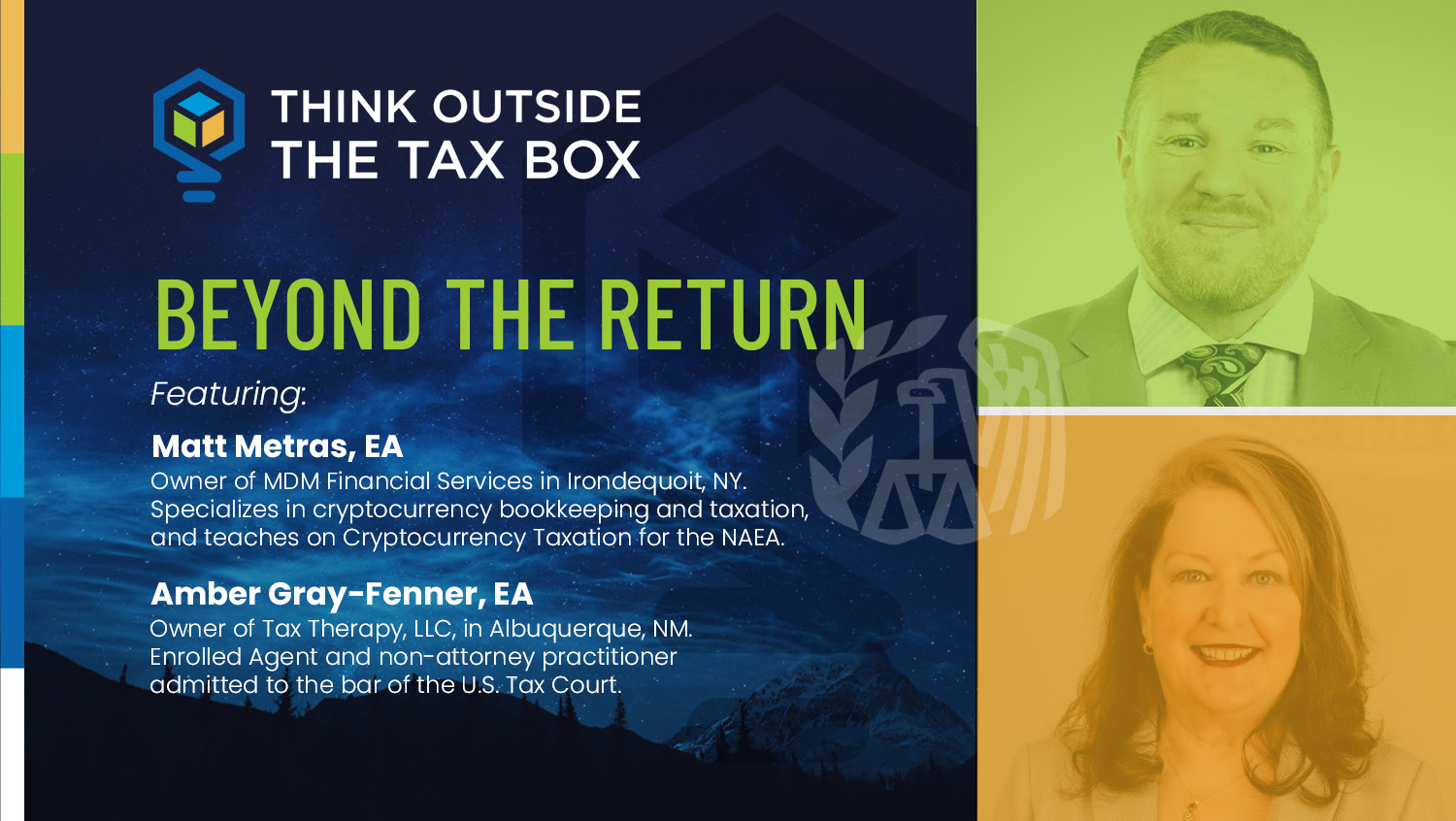

Read MoreBeyond The Returns – Live Webinar Series Event!

Tax season is always demanding. But what comes after? As a dedicated tax professional, it's crucial to continually enhance your practice and adapt to an ever-changing landscape. Introducing the Beyond the Returns Series – an in-depth suite of four live webinars designed to transform your firm's future. Led by industry veterans, Amber Gray-Fenner, EA, NTPI Fellow, USTCP and Matt Metras, EA, this series promises actionable insights to ensure you're well-prepared for the 2024 filing season and the years to come. Don't miss out on this opportunity to redefine and rejuvenate your tax practice.

Read MoreBuilding a Strong Personal Brand as an Accountant: Strategies for Success

What is a personal brand? If you asked me that question in 2018, I would not know how to answer it. As I embarked on my journey to entrepreneurship, I took on any accounting-related project that came my way. I had yet to learn about the meaning of a personal brand. Fast forward to 2020, I launched my CPA firm just before the COVID shutdown. While established CPA firms could sustain or pivot to new services, I still had to figure out how to get clients, build my online presence, and establish trust to create my brand. I learned on my journey that in today’s competitive landscape, a personal brand has become more critical than ever. Professional success is directly related to one’s brand, especially in service-based industries such as accounting. Surveys show that more business owners and young entrepreneurs are looking for accountants they can rely on for not only their technical skills and qualifications but also for a personal connection. Therefore, creating a solid personal brand distinguishes accountants from the rest of the crowd, enhances their credibility, fosters loyalty, and opens doors for new opportunities. I will share my experience, dive into the significance of a personal brand for accountants, and provide actionable strategies to help you build a solid personal brand that resonates with your target audience.

Read MoreSalt Miner’s Run for the Roses Ends with a Big Tax Bill

Judge Mark Holmes of the United States Tax Court expressed admiration for the achievements of Joseph G. Bucci Sr. whose American Rock Salt provides the salt to keep many of the streets in the Northeast passable in the winter. You can learn a bit about that from an interview in New York by Adriane Quinlan . The positive remarks were no help in the ultimate result. Judge Holmes agreed with the IRS that Bucci’s three side hustles — a real estate enterprise, a farm, and some racing horses — were “Activities not engaged in for profit” making losses unallowable. The total tab including accuracy penalties for 2016 and 2017 was $711,980. Judge Holmes explained the result in a bench opinion, which is less formal than a memo decision. The trial began in Buffalo on June 14, 2023.

Read MoreInjured Spouse Relief

“It feels like a sucker punch to the gut.” I was on the phone with a client who was a newlywed and filing with their new spouse for the first time. They kept their paycheck withholding as single. So, they were anticipating a larger than usual tax refund. Like a lot of taxpayers, they spent their refund before they even received it. Each day, they were checking “Where is My Refund ?” and even their IRS account. Then, it happened. Code 898: Refund applied to non-IRS debt . It looked as if they wouldn’t receive that refund they already spent. Now, my client did not know what to do. Before getting married, my client’s spouse told them, “I never get a tax refund.” But they failed to mention why they never got a refund. Honestly, they did not know what their refund was paying for. We later found out that each year the Treasury Department garnished the refund for back child support. My client knew their spouse had child support but did not know they were behind on it. If you have a client in this situation, all hope is not gone. I could help my client find out what offset the tax refund. We could also get a portion of the refund back. You can do the same thing for your client. That is assuming that one spouse is not liable for the debt that offset the tax refund. The IRS calls this injured spouse relief. I’ll walk you through how you can help your client with their refund garnishment sucker punch. Yes, you can help them get their part of the refund back. Let’s start with what injured spouse relief is. Then we’ll look at who qualifies as an injured spouse and how to request injured spouse relief.

Read MoreTAX COURT ROUNDUP – September 2023

This roundup will spend a lot more space than usual on one story, because it’s the biggest of the year in Tax Court so far...

Read MoreNOT A MEMBER YET?

SUBSCRIBE TO GET ALL OF OUR

GREAT ARTICLES AND RESOURCES!

CURRENT EDITION

The Benefits Your Military Veteran Clients Aren’t Using (And Why That’s a Planning Problem)

Why aren’t more veterans using the benefits they’ve earned? Part of the problem is awareness, and part of it is discomfort (for both veterans and advisors). After all, veteran benefits are rooted in service-connected health and trauma, placing them in a category that often feels more personal than financial. That alone can deter veterans from discussing their disability compensation and keep advisors from broaching the subject altogether. The result is financial plans that look optimized on paper but are built on incomplete assumptions and missed opportunities – opportunities that have been more than earned.

Start the Year Right: Your WISP Doesn’t Have to Be a Tax Season Nightmare

The mere mention of a WISP makes most tax professionals want to suddenly lose their internet connection. It sounds bureaucratic, technical, and deeply unfun. But here’s the good news: creating and maintaining a WISP does not have to feel like a compliance root canal. And ignoring it can turn into something far worse than an IRS audit. Let’s talk about why you need one, what it’s actually supposed to do, and how to get it done without wrecking your sanity in the middle of filing season.

Fleeing High Tax States And The Stickiness Of Domicile

Part of preparing to leave a high state tax is facing up to the fact that the tax collectors of high-tax states can be kind of clingy. There is more to changing your residence for tax purposes than simple steps like a new driver’s license and a change in voter registration.