Download now

FreeEBOOK

The OBBA 2026 Toolkit

Our Team of tax experts has distilled all 870 pages of this new law into clear, actionable insights you can use today. Inside, you’ll find:

- What's changing and when it takes effect

- How these changes impact your clients

- Strategies to turn new rules into new opportunities

The Ultimate Newsletter for Tax Professionals

Tap into the latest tax planning ideas, practice management tips, industry updates and more, delivered to your inbox twice a month.

EVERY BI-WEEKLY ISSUE PACKED WITH VALUE:

INNOVATIVE TAX PLANNING IDEAS

Stay ahead with unique, actionable strategies to help your clients save on their taxes.

PRACTICE MANAGEMENT INSIGHTS

Streamline your operations, increase your hourly rates, and attract high-paying clients.

MARKETING & SALES STRATEGIES

Learn how to market your services and bring in the most lucrative clients.

DIGITAL CURRENCY, REAL ESTATE, BUSINESS & MORE

Stay current with strategies for managing your clients’ diversified portfolios.

LEVERAGE AI FOR TAX PROS

Discover how AI can help you save time and boost your efficiency.

CLIENT-READY CONTENT

Share professtional infographics and articles to educate your clients on the best tax practices.

FREE CONTINUING EDUCATION (CE) CREDITS

Access subscriber-only webinars and training, complete with CE credits at no extra cost

FEATURED CONTENT

The Think Outside the Tax Box OBBBA Quick Reference Guide

The One Big Beautiful Bill Act (OBBBA) marks the most sweeping overhaul of the tax code since 2017, reshaping rules across personal and business income, education, healthcare, and credits. To help you stay ahead of the curve, Think Outside the Tax Box is proud to share our Quick Reference Guide, designed to keep you and your clients informed, prepared, and proactive.

CURRENT EDITION

The Benefits Your Military Veteran Clients Aren’t Using (And Why That’s a Planning Problem)

Why aren’t more veterans using the benefits they’ve earned? Part of the problem is awareness, and part of it is discomfort (for both veterans and advisors). After all, veteran benefits are rooted in service-connected health and trauma, placing them in a category that often feels more personal than financial. That alone can deter veterans from discussing their disability compensation and keep advisors from broaching the subject altogether. The result is financial plans that look optimized on paper but are built on incomplete assumptions and missed opportunities – opportunities that have been more than earned.

Start the Year Right: Your WISP Doesn’t Have to Be a Tax Season Nightmare

The mere mention of a WISP makes most tax professionals want to suddenly lose their internet connection. It sounds bureaucratic, technical, and deeply unfun. But here’s the good news: creating and maintaining a WISP does not have to feel like a compliance root canal. And ignoring it can turn into something far worse than an IRS audit. Let’s talk about why you need one, what it’s actually supposed to do, and how to get it done without wrecking your sanity in the middle of filing season.

AI-Powered Solutions for Tax Professionals

Save time & money with our AI Tax Tool – trained by the top tax planning minds in the country.

CUSTOM TAX RESPONSES ON DEMAND

Eliminate manually drafting IRS notice responses. With AI, you can generate tailored tax responses instantly with just a click – saving significant time.

SIMPLIFIED TAX JARGON

Don’t struggle with confusing legal and tax language. The AI translates complex terms and legislation into simplified summaries. You‘ll quickly grasp the important information without the confusion.

ACCESS DOCUMENTS INSTANTLY

Immediate access to a fully searchable tax library. Find specific documents, updates on tax topics, or in-depth resources. You’ll have full control over your research.

GET A VISUAL ON YOUR TAX INSIGHTS

For those who prefer visual learning, the AI generates visual representations of tax data, including charts and diagrams. This makes it easier to analyze and understand tax strategies and information.

EASILY SUMMARIZE DOCUMENTS

Simply enter a prompt to find relevant documents, and let the AI generate the summaries for you. This feature saves you from wading through pages of text, and allows you to quickly extract the key points you need.

BONUS! – EXPLORE OUR eMAGAZINE FOR FREE!

Download a FREE edition of our magazine on ADVANCED TAX STRATEGIES and get a sense of what you will learn!

- Advanced tax strategies from industry leaders

- Logic-based essays that go beyond just the basics

- Commentary and contributions from award-winning authors and tax law leaders

- Reliable resource for compliant and confident practice growth

- Tools to help you simplify your tax practice

Explore Our Free Articles

Get a taste of our comprehensive tax planning insights with four featured articles, free for everyone.

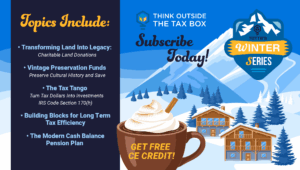

2025 Winter Education Series Event Calendar

Think Outside the Tax Box proudly presents the 2025 Winter Education Series! This October through December, we are bringing our loyal subscribers five webinars featuring some of the brightest minds in tax. Each high quality webinar is filled with engaging content, actionable insights for your clients, and they all come

Charitable Impacts of the One Big Beautiful Bill Act

For charitable-minded taxpayers, several provisions in the One Big Beautiful Bill Act (OB3 Act) will impact the tax reduction associated with their charitable giving starting next year in 2026. In one case, the change increases the deductible amount, but all other changes surprisingly reduce the value of charitable contribution deductions.

The End of the Green Road? The One Big Beautiful Bill and Energy Credits

Just when many believed green tax incentives were firmly established, the One Big Beautiful Bill (OB3), formally designated as Public Law 119-21 and enacted on July 4, 2025, delivers a sudden and sweeping rollback of key energy tax credits. Affecting everything from electric vehicles to rooftop solar, OB3 significantly alters

Editor’s Pick: Tax Planner Faces Malpractice Claims Over Decades-Old Tax Advice—What Went Wrong?

In a case that every tax professional should take note of, the prominent law firm Sidley Austin LLP finds itself defending against claims that it provided faulty tax advice over two decades ago, leading to massive IRS liabilities for a family. The plaintiffs, the Cáceres family, are seeking to recover

Exclusive Webinars for Our Subscribers

As an annual subscriber, you gain complimentary access to our series of expert-led webinars. Each session is designed to provide you with insights, skills, and knowledge to excel in your field. Discover what’s coming up and secure your spot today.

Learn how to interpret and document your tax planning research findings. Learn what you can rely upon, and how to protect your recommendations.

May 23, 2024

From Renting out your house, to forming an LLC, to deducting the family trip to the pumpkin patch, social media is filled with questionable tax advice, much of it shared by credentialed professionals.

May 20, 2025

These educational webinars are included in the Basic or Professional subscription!

Subscribe today!

January 25th, 2025

Don't Miss Our Next Webinar

Mark your calendar and stay ahead of the latest tax planning strategies and regulations

Webinar

TBD

Featured Authors

Amber Gray-Fenner is an Enrolled Agent and tax practitioner specializing in tax returns, planning, and representation for individuals and small businesses. She owns Tax Therapy, LLC in Albuquerque, New Mexico.

Matt Metras, EA, owns MDM Financial Services in NY, specializing in bookkeeping and taxation for cryptocurrency clients. He’s an educator on cryptocurrency taxation and actively engages in community advocacy.

Jeff Stimpson, has been a tax and finance writer for 25 years. Hee contributes to publications like Accounting Today and Financial Advisor. His other credits include sales tax, technology, and practice management, residing in New York.

Annette Nellen is a professor and tax program director at San José State University, with extensive involvement in tax organizations and a focus on tax policy, cryptocurrency, and education.

Peter J Reilly graduated from the College of the Holy Cross and worked in CPA firms like Joseph B Cohan and Associates and CCR LLP. He formerly wrote for Forbes.com.

Thomas Gorczynski, EA USTCP CTP, is a tax expert known for speaking and educating on federal tax law. He’s editor-in-chief of EA Journal, co-author of the PassKey Learning Systems EA Review Series, and runs a tax practice in Phoenix, Arizona.

Hear From Our Satisfied Users

Quotes from users who have benefited from Tax Law Pro, highlighting how it has helped them in their tax planning and compliance efforts.

SIMPLIFIED TAX STRATEGIES &

PRACTICAL IMPLEMENTATION

Think Outside the Tax Box provides tax reduction strategies along with practical

implementation advice in order to reduce your clients’ federal tax bill with ease.