SPONSORED EVENT

We’re hosting a class to help educate you on qualified plans with unique options! As a monthly or annual subscriber this live course is 100% exclusive, and free to you! All you need to do is sign-up for the event!

Qualified Plans with Unique Options on December 14th, 2022 @ 11am PST!

The presentation will discuss qualified plans for business owners and their employees. Be prepared to learn about (DC) Defined Contribution and (DB) Defined Benefit Plans, plus unique options available to plan participants. Participants will learn strategies to increase their annual contributions beyond defined contribution limitations. Finally, we will discuss strategies to reward business owners, key employees, and strategies to utilize unique plan options within Qualified Plans.

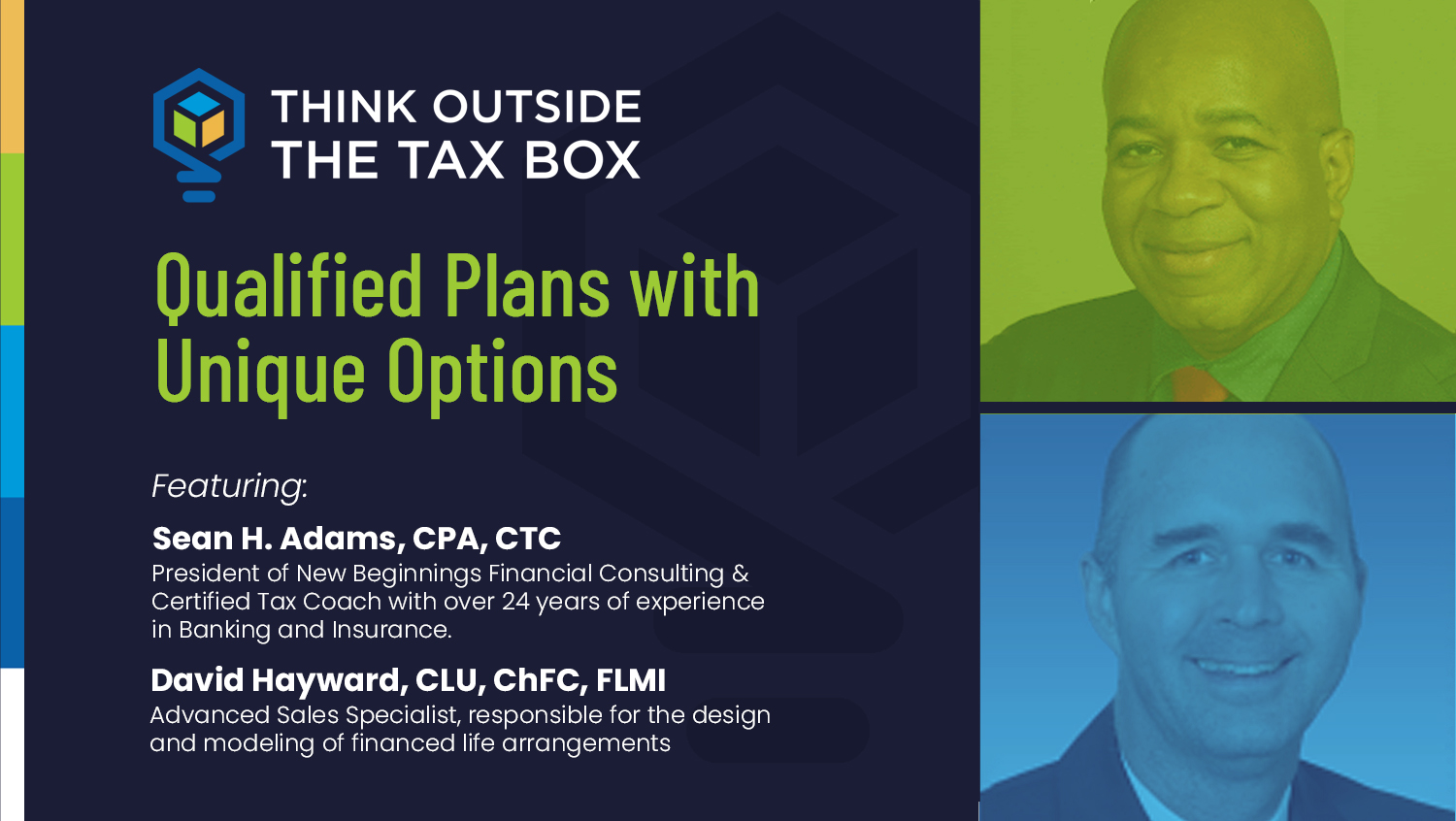

This one-hour course will be hosted by our sponsor, New Beginnings Financial Consulting, and conducted by Sean Adams, CPA and President of NBFC, and David Hayward, CLU, ChFC, FLMI.

This course is 100% free to our subscribers!

We are offering a free continuing education credit to all qualifying participants!

In A Nutshell

WHY: To educate you and your small business clients on qualified plans!

WHO: Sean Adams, CPA and David Hayward, CLU, ChFC, FLMI

WHAT: A live webinar course!

WHEN: December 14th, 2022 @ 11am to 12pm PST

WHERE: Zoom!

HOW: It’s exclusive and free to all TOTTB subscribers!

WHAT COULD POSSIBLY MAKE THIS BETTER!?: We are offering a free CE Credit for qualifying attendees courtesy of the American Institute of Certified Tax Planners!