CURRENT EDITION

Contracts, Signing Bonuses, and the Substantial Presence Test

In tighter job markets, recruits are often offered signing bonuses (and sometimes moving expenses) to join a firm. Sometimes construction workers temporarily relocate to jobs in other states while they are employed by the company that hired them in their home state. This article reviews some of the foundational tax concepts to consider when evaluating sourcing of income for state tax purposes.

READ MORE2022 Summer Education Series Event Calendar

TOTTB proudly introduces our 2022 SUMMER EDUCATION SERIES! That’s right! Every month through August we will be bringing you a FREE, live webinar event to help educate and inspire you on all things tax! As a monthly or annual subscriber, these webinars are 100% exclusive, and free to you! Guest speakers include regular columnist, Peter Reilly, Boston Tax Institute Founder, Lucien Gauthier, the Tax Mama, Eva Rosenberg, and more! Every webinar comes with free continuing education credits for those who qualify! Keep reading for more details...

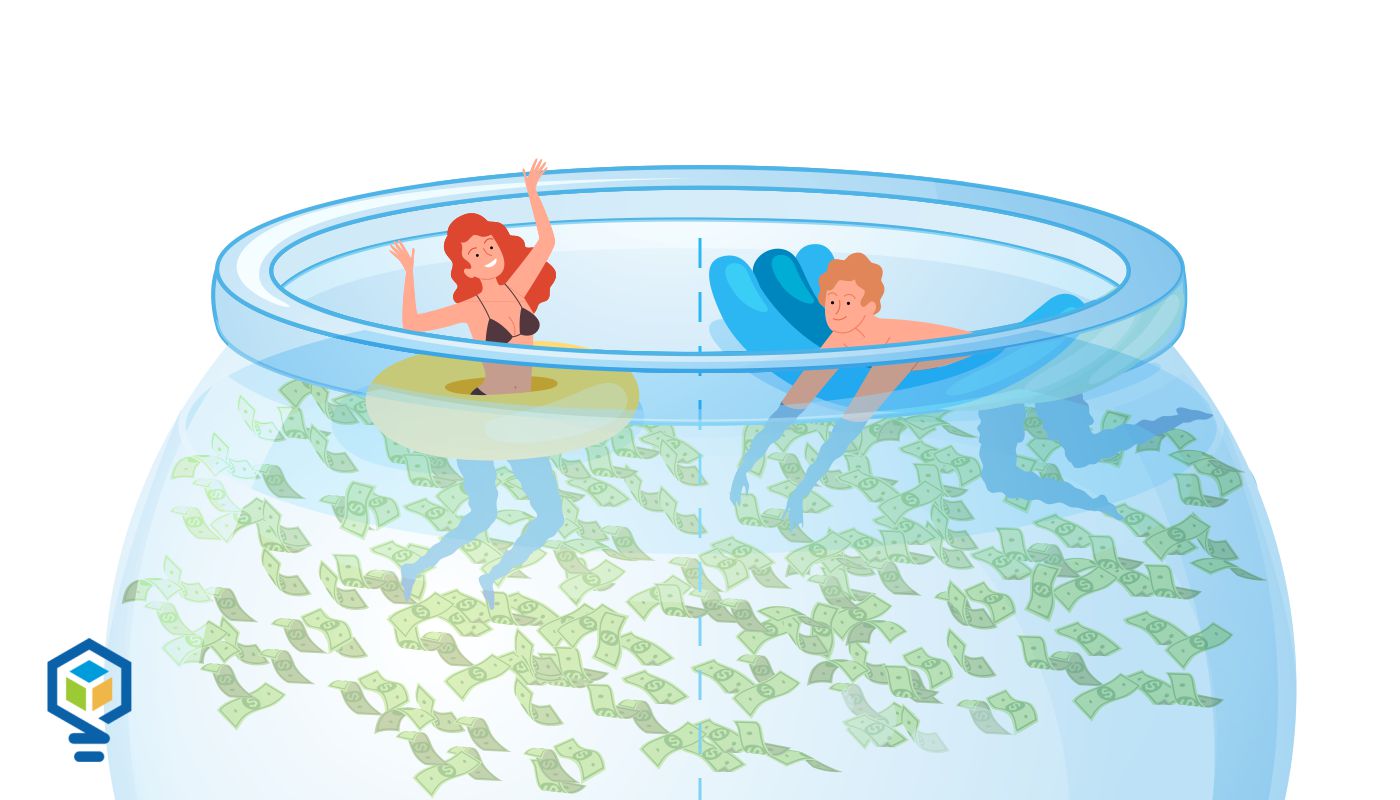

Read MoreThe Bucket List (Part 1): Living Large in Retirement While Minimizing Your Taxes

We've all heard the messages to pay yourself first, save a percentage of your income, build your nest egg, and some of us heeded the messages. Whether you’ve saved a lot or a little, we have many ways to reduce taxes in retirement, and by doing so, we maximize the power of our retirement savings. Accumulating retirement funds is step one. And there are tax-advantaged ways to save for retirement: employer plans (401(k), 403(b), 457), individual retirement accounts (IRAs), self-employed retirement plans (Keogh, SEP, SIMPLE, Solo 401(k)), and non-retirement accounts. While you’re saving, you may have accumulated multiple “buckets” of assets, some in taxable accounts, some tax-deferred, some nontaxable. Looking ahead toward retirement withdrawals/distributions (the funds you’ll need for essential and discretionary living expenses) adds tremendous value, and tax planning is a big part of the picture. Read on for more specifics and stay tuned for Part 2 with additional tips and examples.

Read MoreDo Your Clients Know Their Own Business Entity?

Have you been working with a partnership client or Schedule C client for a couple of years, only to find out: “Oh, by the way, we incorporated two years ago?” Or the taxpayer brings you a notice for non-filing penalties on the partnership or S corporation you didn’t know existed? When you are working with existing business clients for several years, you are not concerned about their prevailing business structure. After all, if you have been filing the wrong entity’s tax return, you would have been alerted by now. Right? As it turns out, not always. When you find out about the error, your gut reaction is that it’s your fault. Is your errors and omissions insurance (or malpractice insurance) up to date? Take a deep breath; it’s not your fault. Probably. Let's keep reading and find out.

Read MoreHow to Withdraw Cash from Your C Corporation Tax-free

Question: I understand the concept of paying just 21 percent tax through a C corporation. This makes sense if my tax rate is higher than, say 25 percent or 35 percent. But isn’t this money taxable to me as a dividend as soon as I withdraw it from the corporation? I don’t understand; won’t that actually cost me more tax? Answer: You have identified the exact reason C corporations can be what we call “high maintenance.” You’re right. Done in the wrong way, using a C corporation can actually cost more in tax than using a pass-through entity and paying tax at your individual rate, even if that rate is, say, 35 percent. By the time you pay qualified dividends tax on any withdrawals, you can wind up paying 45 percent or even 50 percent, depending on your individual tax rate. The key is to use smart planning. Rather than simply withdrawing the funds from your C corporation as a taxable dividend, use one six ways to withdraw tax-free instead. Doing this will help you lock in the low 21 percent flat rate and permanently save you from your high individual tax brackets. Keep reading to learn more.

Read MoreJoint Filing – An Election Not a Marital Vow

The flurry of tax provisions, meant to alleviate the economic dislocation of the Covid plague, have made many tax practitioners sensitive to the possibility of Married Filing Separately yielding a lower tax for a couple. Back in the day, it was rare enough that many felt they could safely ignore it. Lindsay Starrett of Baker Starrett in Grinnell, Iowa, gave me an example of saving taxpayers $3,500. I am not going to try to parse the details of that or other examples. I will just refer you to Reilly’s Sixth Law of Tax Planning: Don’t do the math in your head. Have good software and code income items as taxpayer, spouse, or joint. You may need to run multiple computations moving the dependent’s around. Also be aware, the IRS may not be as cooperative as it should be in allocating estimated tax payments. One of my old friends wrote me: "In 2020, we did MFS returns for the $10,200 unemployment exclusion and learned the IRS is unable to …" Click here to continue reading.

Read MoreUpgrade Your Client Experience with a New Mindset

Sponsored by Liscio You care deeply about your clients. It’s why you got into this business: to have a direct impact on your clients’ success. With this in mind, understanding where your firm falls on the spectrum of great vs. poor client experience is fundamental to your success. At its core, drop-dead easy, secure digital communication and document exchange are everything in your clients’ minds, even if they don’t say it. Beyond just taking great care of your clients, if you want to get paid premium fees, you have to deliver a premium experience. Keep reading to learn how to deliver premium level service.

Read MoreShould You Switch Your Work Strategy for Tax Planning Season?

If you’re like most tax professionals, you’re probably working tax-prep season hyper-focused and -vigilant, refusing to hit pause except on absolute demand. You’re keeping a sharp eye on the ball, the players, and the end goal: maximizing your resources and providing impeccable service to your clients. Now, when you have lots of familiar, practiced work to do in little time, working like this can produce great results. However, tax-prep season is ending, and tax-reduction planning season is beginning. Therein, hyper-focus, hyper-vigilance, and workdays, weeks, and months without meaningful rest can backfire and steal from you the results you hope to produce. That’s because reactively responding to external demands and deadlines (set by clients and the IRS, for example), requires something different from you doing proactive designing and selling high-end tax plans. Consider this, as you shift from tax-prep to tax planning, you: ● Soften your focus on computers, numbers, and speed and sharpen your focus on talking with prospective clients about their finances, their hopes and worries about their business and family, and how you might best serve them. This requires a shift from grinding and discipline to presence and attunement. ● Soften your focus on meeting immediate deliverables and sharpen your focus on developing long-term strategies for products you offer and your business overall. This requires a shift from following rules, structures, and guidance to thinking creatively and working socially. ● Soften your focus on external deadlines and client demands and sharpen your focus on your own ambitions and drive to get things done. This requires a shift from aligning your priorities with others’ agendas to aligning your priorities with your own dreams and goals. Making shifts like these can be challenging, particularly if tax-prep season devours you and you enter tax-reduction planning season depleted and drained. However, taking time now to recharge and reset can help you pivot and produce powerful results in the end. Did Tax Season Devour and Deplete You? When it comes to personal performance in business, I like to contrast two modes of working: Depleted Mode and Resourced Mode. These modes aren’t binary; rather, they’re two ends of a continuum that we all constantly move along. Generally, when you find yourself highly distracted and distractible, pushing yourself to keep going, and working excessive hours to make up for lost time, you’re in Depleted Mode. Tax-prep season unfailingly produces this outcome for the best of tax pros. Exhaustion (or simple tiredness), frustration, and a taxed mind (pun intended) live here. When you’re drawn into your work, interested in the results you produce, and loving what you do, you’re in Resourced Mode. Enthusiasm, creativity, and connection live here. Resourced Mode offers an ideal environment to tax pros for engaging with the demands of tax planning season. You’ve probably seen yourself operate in both of these modes and along the continuum. Many tax professionals start the tax-prep season in Resourced Mode but end in Depleted Mode after months of hyper-focus and -vigilance, both of which you can only sustain in short bursts. There’s nothing wrong with Depleted Mode; most people land themselves there through hard work and commitment. (Incidentally, you can build systems and structures to reduce or avoid Depletion Mode over time, but that’s a topic for another day.) Many people produce great work in Depleted Mode, and that can trick them into thinking it’s effective for every kind of work. You can do tax prep in Depleted Mode, for example, because the work is familiar, somewhat predictable and consistent, and ultimately requires less mental engagement. However, Depleted Mode renders fewer productive results in tax-planning season because there you need deeper thought, mental space and physical energy to develop a strategy, a connection to people, and effectively sales. Ultimately, even in situations where Depleted Mode works decently, Depleted Mode can lead to: ▪ Procrastination: Being overworked and under-rested drains your mental capacity and leads to internal resistance on projects that require more mental energy. ▪ Distractibility: Quick changes of focus habituate your brain to prioritize distractions instead of focused work, so you might find yourself putting “easy” work ahead of “valuable” work. ▪ Agitation: Fast pacing can create agitation, or a constant background sense of worry, which can hinder progress when you try to settle into something that requires deeper thinking, such as tax or business strategy (which requires divergent, non-linear thinking). ▪ Lower pay for more work: procrastination, distractibility, and agitation make it difficult to approach valuable work (higher-paying, more satisfying), leaving you to do easy work instead (lower-paying, less satisfying) so you feel as if you accomplish something. ▪ Cyclical depletion: In Depleted Mode, you produce less per hour, make up for it by working more hours, and stay in Depleted Mode by overworking yourself. Still working in depleted mode? Click here to learn how to shut down the grind and turn on the productivity.

Read MoreFiling Separate Returns To Maximize Credits

I have always thought of separate filing as something that filers should seriously consider for the final year of marriage or in circumstances where you think your spouse has significant audit exposure that you don’t want to share. The circumstances in which two married filing separate returns would yield a lower aggregate tax than a joint return were so rare that everyone I knew entirely discounted it. Things are different in 2021 (Also in 2020, but that is water under the bridge). What is driving the phenomenon are recovery rebate credits (which many received as economic income payments) and child tax credits. Be sure and read this before sending those electronic returns before the 18th. You may just have some savings there. Click here to keep reading.

Read MoreNOT A MEMBER YET?

SUBSCRIBE TO GET ALL OF OUR

GREAT ARTICLES AND RESOURCES!

CURRENT EDITION

Contracts, Signing Bonuses, and the Substantial Presence Test

In tighter job markets, recruits are often offered signing bonuses (and sometimes moving expenses) to join a firm. Sometimes construction workers temporarily relocate to jobs in other states while they are employed by the company that hired them in their home state. This article reviews some of the foundational tax concepts to consider when evaluating sourcing of income for state tax purposes.

Help Clients Rebuild Tax Records After Disaster

Tax pros help clients with a lot of catastrophes: wrangles with tax authorities, paltry nest eggs, more wrangles with tax authorities. More frequently, your clients might face a more tangible and cinematic disaster. These days, there’s always a storm comin’. Swept away in that destruction, for many people, are physical tax and financial records. A few precautions could have prevented such loss and made life at least a bit easier for victims. Here’s how to help clients head off trouble – and recover after it hits.

George M. Cohan’s Tax Triumph: The Rise and Erosion of the Cohan Rule

The Cohan rule is named for George M. Cohan. George Michael Cohan (1878 – 1942) was a theatrical producer. In the decade before World War I, he was called the “man who owned Broadway” and is considered the father of American musical comedy. In 1940 he was awarded the Congressional Gold Medal for his contribution to morale during World War I with his songs “You’re a Grand Old Flag” and “Over There,” the first time the medal was awarded to someone in an artistic field. But his most enduring legacy may be the tax rule that shared its name.