CURRENT EDITION

Summertime Marketing in Your Tax & Accounting Firm

Tax season is prosperous, summer is dry until extension season. Do you find yourself in that cycle? Clients are “easy” to get during tax season when taxes are top of mind. Then the direct deposits go dry by June, and you are looking for what’s next. Stop the search, you don’t have to add another service. You need better marketing to highlight the service that you offer and specialize in. This will allow you to have a predictable client pipeline. You can do tax preparation, planning, and or representation all year long.

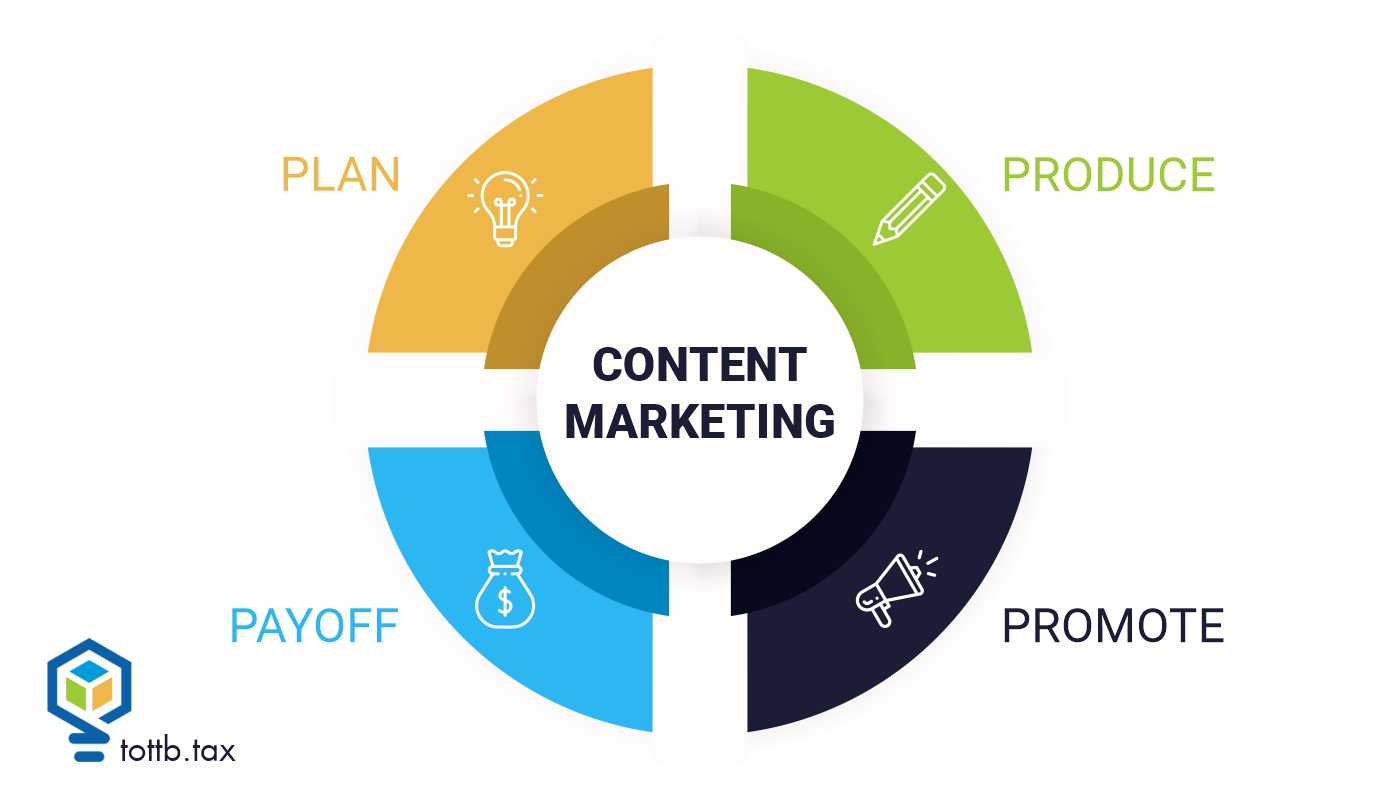

READ MOREContent Marketing for Accountants: Creating Valuable and Engaging Content

If you read my article Building a Strong Personal Brand as an Accountant: Strategies for Success you’d have learned about how I started my entrepreneurial journey in 2018, knowing absolutely nothing about marketing. I was one of those CFOs who would need to understand why a company has to spend more money on marketing; however, I did understand that having a robust online presence was necessary for a new digital age. Little did I know that marketing is senior to any other activity in a business.

Read MoreSome Harsh Lessons on Being Late from the Tax Court

Penalties for procrastination in tax matters can be somewhat harsh. Judge Albert Lauber of the United States Tax Court gave us some lessons on the topic earlier this year. The “strategy” of over withholding so that you can file your return whenever the spirit moves you rather than by the due date has a serious downside. The statute of limitations will not work in your favor, but it will work against you. It is a little like you are playing in a chess tournament and you and your opponent are staring at the board. Your clock is ticking and theirs is not.

Read MoreCan You Write Off Your Vacation on Your Taxes?

I saw a meme that said, “accountants go on vacation just so they can work from another location.” This might be true. So maybe, just maybe you can write your vacation off on your taxes. But on a serious note, this is a question that taxpayers have. “Can I write off my vacation on my taxes?” I hate to blame everything on the internet but...it is a dangerous place for taxpayers. There is an infamous Tik Tok video turned reel that has found its way into my DMs and e-mail inbox several times. I’m often amused by the bad tax advice that goes viral online. The comments tend to make me giggle or give me cause for concern. This particular video gave me more cause for concern. The main reason it did this is because of the amount of tax professionals that shared in agreement. I’m all for advertising on social media but often we must be careful as tax professionals. We have certain ethical obligations that unfortunately do not apply to other industries. We do not want to mislead taxpayers for “likes” or potentially going viral. Let me get to the details of the video. A tax professional whose credentials I won’t mention, was sharing how taxpayers can use their entire family vacation as a write off on their Schedule C. Rightfully so, this made taxpayer’s ears perk up. Why not kill two birds with one stone, right? What should not have happened was tax professionals sharing the video with filling in the blanks. I know you would never do that, and that’s why you’re here. To find out what parts of travel your client can write off on their taxes. So, let’s look at what constitutes something being a business expense. Then we’ll look at the due diligence you should take to make sure their travel and meal expenses are legitimate.

Read MoreWhat’s at Stake? It’s Not a Loaf of Bread

The IRS loves to issue cryptocurrency guidance when it’s the most inconvenient for me personally. I’m not sure how they accessed my calendar, but it certainly feels like this one was intentional. I was at a tax conference over the summer to teach an introduction to crypto class immediately after lunch. I had just finished eating when my phone started blowing up. The IRS published a new Revenue Ruling on Staking, 45 minutes before I was to teach about it. I read the six-page document, tried to digest it, and considered how I needed to adapt my material on the fly. Another frequent (but not to be named) Tax Box contributor present at the conference teased me about the situation I found myself in. The class went fine, though, because even with a surprise ruling, the IRS didn’t really say anything surprising. In typical IRS fashion, it also created more questions than it answered.

Read MoreSome of What You Need to Know to Do 1041 Right Because Nobody Knows Everything

There was a recent IRS memo from an associate chief counsel that should be shocking but actually isn’t. Promoters have for many years been hawking a “copyrighted non-grantor irrevocable complex discretionary spendthrift trust,” which purported to avoid capital gains tax. You could learn about it on TikTok. It “worked” by citing Section 643(a)(3), which excludes capital gains allocable to corpus from distributable net income. You and I both know that DNI is not taxable income, but not everybody who learns the tax law from TikTok has caught onto that subtle point yet. Although I have never encountered anything as egregious as the “copyrighted, etc, etc, trust” I have seen a lot of problems with trusts over the years (and partnerships and SALT – don’t get me started). Much of it has to do with working under a lot of pressure. Often, the things that are wrong end up not mattering all that much, but I get a little frightened, because maybe one of these days the IRS is going to start getting its act back together. If it does, I think things may be a little shocking to practitioners who have grown up in an environment where enforcement has been progressively gutted.

Read MoreA Supreme Court Decision Could Rewrite Penalties for Foreign Accounts

Tax reporting of overseas accounts has always been an extra chore for some American taxpayers. Now they might have to play a guessing game as well after the Supreme Court’s Bittner decision early this year. The case is a prime example of how taxpayers with international holdings might wrest better tax judgments in the future.

Read MoreTAX COURT ROUNDUP – OCTOBER 2023

The latest Federal Tax Court news, updates, and hot topics!

Read MoreTax and Financial Planning for Special Needs

The astronomical costs of a disability can extend beyond extra therapy and special equipment to, potentially, a lifetime of lost earnings. There is some help. The federal government has tax deductions and credits connected with raising a child with special needs, for instance. And though historically a trust has been only financial avenue to care for a disabled loved one, another vehicle is gaining traction. Many tax and financial moves in this area come down to one question that’s unique to this planning: Will money interfere with a disabled person’s ability to get indispensable government benefits?

Read MoreNOT A MEMBER YET?

SUBSCRIBE TO GET ALL OF OUR

GREAT ARTICLES AND RESOURCES!

CURRENT EDITION

Summertime Marketing in Your Tax & Accounting Firm

Tax season is prosperous, summer is dry until extension season. Do you find yourself in that cycle? Clients are “easy” to get during tax season when taxes are top of mind. Then the direct deposits go dry by June, and you are looking for what’s next. Stop the search, you don’t have to add another service. You need better marketing to highlight the service that you offer and specialize in. This will allow you to have a predictable client pipeline. You can do tax preparation, planning, and or representation all year long.

Observations on the House-Passed OBBB

This article focuses on the OBBB from the House offering a variety of observations to help understand the range of changes, relevance to compliance and planning, process considerations and some unexpected provisions. While the final OBBB will not include all of the House provisions or will modify some of them, there are lessons to learn to understand the tax legislation process and results now and in the future.

Client Retention as a Prospecting Strategy: Turning Current Clients into Referral Sources

In the competitive accounting world, where trust and reliability are paramount, client retention is not just a success metric—it’s a vital strategy for sustainable growth. For Certified Public Accountants (CPAs), accountants, and bookkeepers, maintaining a solid relationship with existing clients can unlock new business opportunities, turning satisfied clients into powerful referral sources.