LOOKING FOR LEGAL WAYS

TO REDUCE TAX?

New tax reduction strategies carefully explained and exhaustively researched every two weeks. Receive breaking news updates on tax law changes. Members only monthly AMA with TOTTB.tax.

WE PUBLISH TAX STRATEGIES FOR…

FEATURED CONTENT

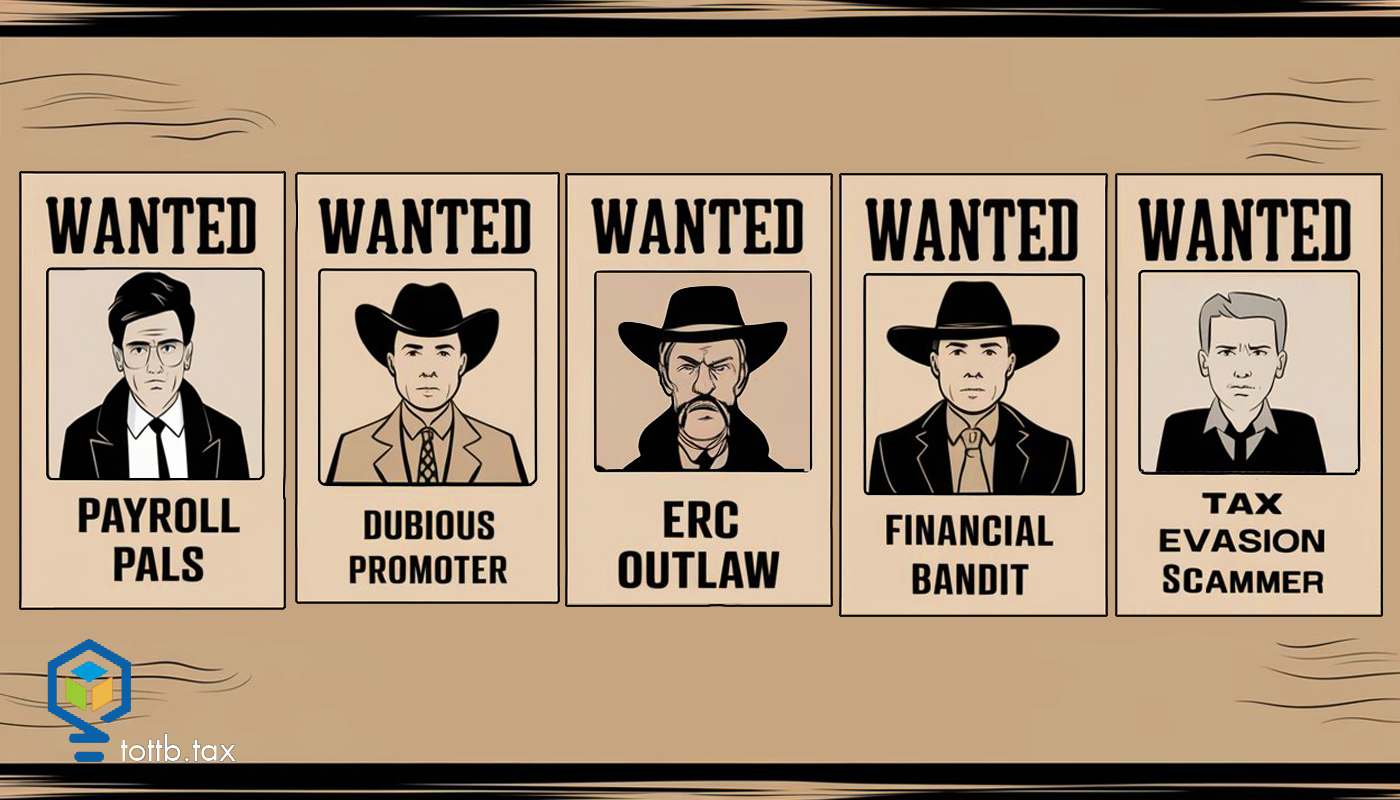

The Wild West of Employee Retention Credits (ERC): Outlaws, Deputies, and Cowboys

Gather 'round, pardners! The Employee Retention Credit (ERC) has been the latest gold rush in the tax frontier, drawing business owners, tax deputies, and even a few sly outlaws. But as the dust settles, the IRS—our law keeping sheriff—is on the hunt for any who might’ve bent the rules. In this frontier of finance, knowing who’s who can keep you out of trouble as the IRS rounds up dubious claims.

Read MoreCURRENT EDITION

Tax Tales I Let Slip in 2025: From Whistleblowers to Easement Woes and Beyond

One of my greatest frustrations as a tax writer is that I just don’t have the time to cover everything that I notice. Early in my blogging career, when I was younger and had more energy, I set myself on a Monday, Wednesday, Friday schedule like the college professors I envied. Even that did not keep up with everything I noticed, so periodically I would do a post that had short blurbs about interesting things I didn’t dig further on. Here is an example from 2010 of a post that covers an entity not considered a church by the IRS, S corp shareholder basis issues, definition of alimony and two Chief Counsel Advices on TEFRA issues. So here are some things for 2025, that I opened a file on but never managed to make an article with.

The IRS in 2025: A Snapshot of Reality

The IRS is not the same agency we dealt with a decade ago, or even three years ago. The pandemic accelerated operational strain, exposing long-standing infrastructure weaknesses while also prompting overdue investment and modernization. Some areas have improved meaningfully, including digital tools, faster account updates, and improved phone service during filing season. Other areas, however, feel frozen in time. Correspondence units remain slow, backlogs persist, and automated notices often fail to reflect what is actually happening on a taxpayer’s account. This article outlines the practical realities of working with the IRS in 2025, what strategies are working, what remains broken, and how to set clear, healthy expectations so you can deliver results without burning out.

The IRS in 2026: A Strategic Field Guide for Tax Professionals

As we head into the 2026 filing season, tax professionals are operating in an environment unlike any we have seen in recent memory: a smaller and more automated IRS, the new OBBBA, and rapid experimentation with AI-enabled tools inside the Service. This field guide is designed to separate what we know for sure from where the IRS is likely to move next, and to translate both into practical planning moves. It does not predict the future; instead, it offers a structured way to think about enforcement, documentation, and client strategy when the rules, the technology, and the politics are all in motion.

SIMPLIFIED TAX STRATEGIES &

PRACTICAL IMPLEMENTATION

Think Outside the Tax Box provides tax reduction strategies along with practical

implementation advice in order to reduce your clients’ federal tax bill with ease.