Looking to save money by moving to a low tax state? If so, determining how much you will save in taxes by moving is a question many people are often asking that doesn’t have a simple answer. Many people miss out big time because they simply think about state income taxes.

However, there are so many other types of taxes that can be just as important when thinking about moving to a new state.

Simply because a state has low (or no) income taxes doesn’t necessarily mean it’s a low overall tax state. Other taxes such as sales tax, payroll tax, and property tax can have just as big an impact on your taxes as the traditional income tax.

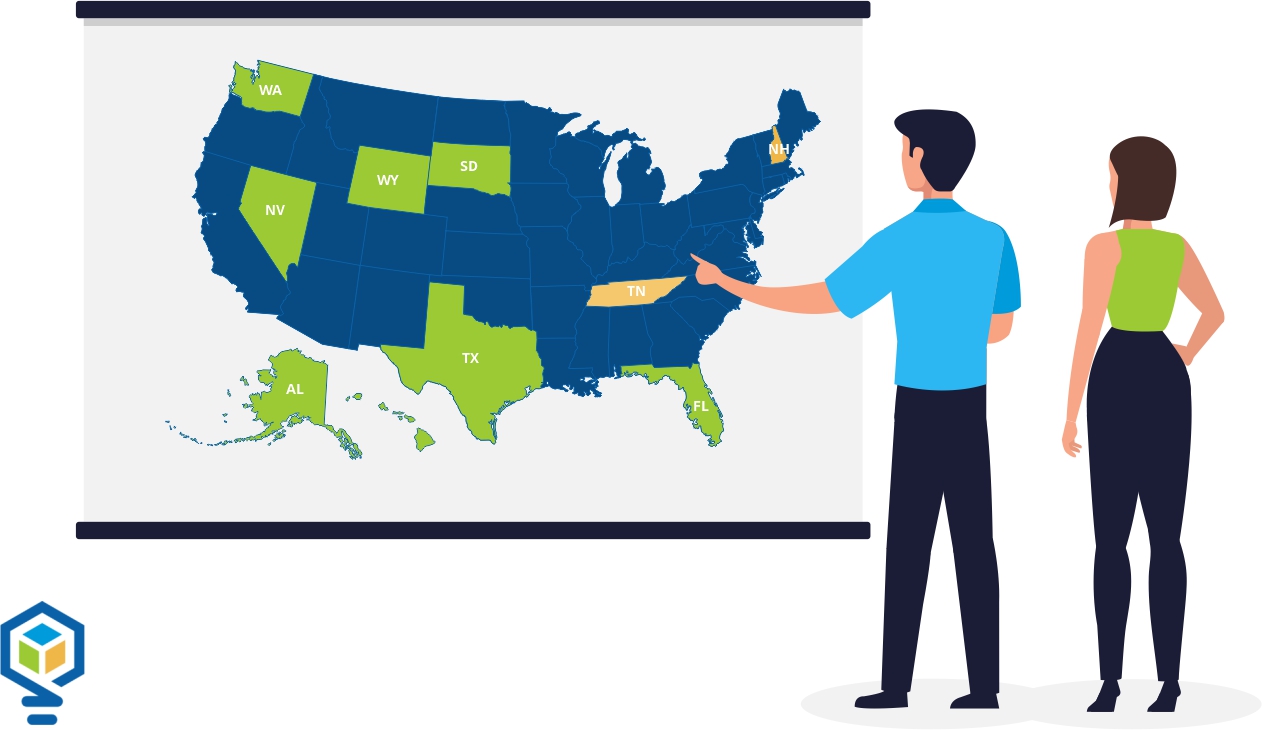

Don’t get hit with unexpected “stealth taxes,” when moving to a low tax state, while state tax free states are great, out of the seven states without an income tax, three are not in the top 10 lowest tax burden states.

Keep reading to learn how to choose the lower tax places to live.