First, you need to get an EIN, then get an LLC, establish business credit, and then you can buy a car in your business name. That process may get you a new car but that does not make it a business expense or eligible for a credit. Friends, that is not how this works; that is not how any of this works.

I’ve noticed a recent obsession in the online business world with writing off car expenses. Especially clean vehicles since President Biden signed the Inflation Reduction Act in August.

There is a correct way to do so, and then, there are a variety of ways to do it incorrectly. If you don’t believe me, just scroll through TikTok and Instagram, it will make your head hurt.

Misinterpretations of Section 179 have set the internet ablaze. That is why I want to make sure we set the record straight on how the clean vehicle credit can benefit businesses. That is if your client follows the guidelines set by the IRS. *Hint, hint: It requires more than buying the car in your business name using your business credit.

Let’s look at the amendments and additions to the IRC that make this credit valuable to business owners too. You have an opportunity to help your clients save $7,500 to $40,000[1] when they buy a qualifying clean commercial vehicle from now until December 31, 2032.

What Is a Clean Commercial Vehicle?

A $40,000 reduction of your client’s tax liability is important. Not all environmentally friendly vehicles will qualify for that amount, but that is the amount that will catch everyone’s attention. Congress has added a completely new section to the IRC for vehicles that do qualify. Let’s look at Section 45W where Congress has defined a clean commercial vehicle.

Section 45W(c)(1) The vehicle must meet the requirements of Section 30D(d)(1)(c ) and purchased for the use or lease by the taxpayer and not for resale.

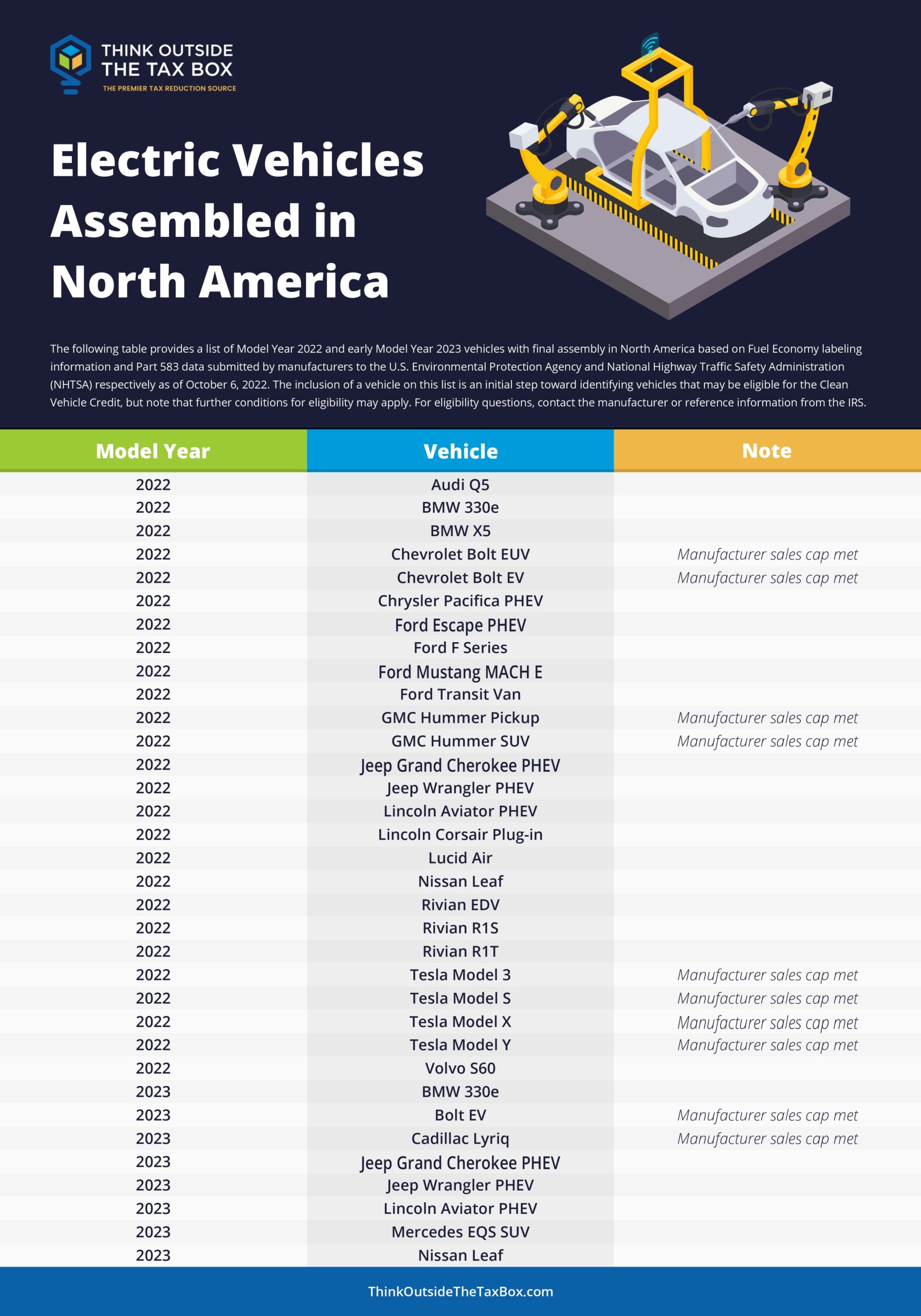

We went over this in more detail last time. So just to quickly recap, this means the final assembly must take place in North America. There are also certain requirements for battery and mineral sourcing. If the manufacturer doesn’t meet these requirements, the car does not qualify. Check out: Inflation Reduction Act Clean Vehicle Credit for more details.

- 45W(c)(2)(A) meets the requirements of subparagraph (D) of section 30D(d)(1) and is manufactured primarily for use on the public streets, roads, and highways (not including a vehicle operated exclusively on a rail or rails), or

- $45(c)(2)(B) is mobile machinery, as defined by section 4053(8) (including vehicles not designed to perform a function of transporting a load over the public highways.

This is where things begin to get interesting. The heavier an electric vehicle is, the less efficient it is. So being heavy has not been a goal of manufacturers. There are some North American manufacturers that make clean commercial vehicles, but they are light. Even the Ford E-Transit line weighs less than 14,000 pounds.

We may see a push toward more e-buses and shuttles within the next 10 years to capitalize on the $40,000 credit.

The game changer is within Section 45W(c)(2)(B). Mobile machinery defined in Section 4053(8) is a vehicle with a chassis that has been permanently mounted to perform a certain job. The jobs include:

- Construction.

- Drilling.

- Farming.

- Manufacturing.

- Mining.

- Processing.

- Timbering.

- Similar operations.

That is if the operation of machinery or equipment does not relate to transportation on public highways. So now the above industries can enjoy this clean commercial vehicle credit, which should not only help them but, in turn, help the economy. If you have clients in one of these industries, you should bring these potential savings to their attention.

Companies like John Deere are introducing lines of electric equipment.[2] They have already created a self-propelled combine harvester. Equipment like this weighs roughly 33,869 pounds.[3] Research by Machinio[4] shows the price being between $159,000 and $179,500 for the diesel version. Assuming a clean version would be similar in weight and price, that machine would qualify for a $26,926 credit.[5] That is 15 percent of the MRSP.

- 45W(c)(3)(A) is propelled to a significant extent by an electric motor, which draws electricity from a battery, which has the capacity of no less than 15 kilowatt hours (or, in the case of a vehicle which has a gross vehicle weight of less than 14,000 pounds, 7 kilowatt hours) and is capable of being recharged from an external source of electricity…

- 45W(c)(3)(B) is a motor vehicle, which satisfies the requirements under subparagraphs (A) and (B) of section 30(B)(b)(3).

This section lets us know that the clean commercial vehicle does not have to be a plug-in electric vehicle. It can be a fuel cell motor vehicle, which converts chemical energy to electricity. An example is the Hyundai Xcient,[6] the world’s first fuel cell truck. Unfortunately, it does not currently meet the manufacturing requirements for the credit.

- 45W(c)(4) is a character subject to the allowance of depreciation.

Subject to the allowance of depreciation means that the vehicle is a wasting asset. The value goes down over time, and we record it as such on a company’s financial statements and tax return.

Now that we know what type of vehicle qualifies, let’s take a closer look at how to calculate the credit.

How Is the Credit Amount Figured?

Weight is a determining factor when it comes to figuring the credit for commercial vehicles. Congress limits the credit to $7,500[7] for vehicles with a gross weight of less than 14,000 pounds.[8] For all clean commercial vehicles that weigh more than that, Congress has limited the credit to $40,000.[9]

These credits are per qualifying vehicle. The qualified clean commercial vehicle credit is for the year the taxpayer puts the vehicle in service. So, what does that look like?

The credit is the lesser of 15 percent[10] of the basis of the clean commercial vehicle or the incremental cost.[11] If the vehicle is not powered by a gasoline or diesel combustion engine, it goes up to 30 percent.[12]

Let’s say Derby Construction purchases a fleet of four 2023 Ford F-150 Lightning Lariats in 2023. The base price in Louisville, Kentucky is $74,474,[13] and they weigh 6,500 pounds[14] when equipped with a battery.

A gasoline or diesel internal combustion engine does not power the Lariat. So, we can look at 30 percent of the base price to figure the credit, which is $22,342.20. However, due to the weight of the vehicle the maximum credit per truck is $7,500.[15] They can apply this $30,000 non-refundable credit to their 2023 tax liability, the year they place the trucks in service.[16]

Section 45W(b)(2) defines incremental cost as the amount equal to the excess of the purchase price for a similar vehicle over such price of a comparable vehicle. This is the price difference between a clean vehicle and a similar vehicle that is not environmentally clean. A comparable vehicle is one powered only by a gasoline or diesel internal combustion engine that is similar in size and use.

Using the same details from the example above, let’s look at the incremental costs. A comparable vehicle is the 2023 F-150 Lariat. The base MSRP in Louisville, Kentucky is $61,270.[17] So, the incremental cost is $13,204. This is the price difference between the Lightning Lariat and the Lariat. The credit would be $13,204 but due to the weight, Congress has limited the credit to $7,500.[18]

Let’s throw another wrench into the example. Derby Construction is a new client, and you did not help it with tax planning for 2023. Mr. Derby, the owner, purchased an F-150 Lightning Lariat for himself, too. He believes he will receive a $7,500 clean vehicle credit for himself and a $7,500 credit for the business. One thing that Congress leaves no ambiguity about is there will be no double dipping with the credit.[19]

If the taxpayer has used the vehicle for the clean vehicle credit, they cannot use the same vehicle for the commercial clean vehicle credit. You will want to make sure you reiterate this to clients in your planning meetings. That way you stay the hero and not the bad guy for telling them after the fact.

This is what we know for now. Section 45W(f) does give room for the secretary to issue regulations and other guidance. The clause is when it is necessary. This leaves room for the different things we may encounter with this credit over the next 10 years.

Summary

The Inflation Reduction Act incentivizes the purchasing and manufacturing of clean vehicles in North America. It also extends the credit to businesses with qualified clean commercial vehicles in Section 45W. This not only includes passenger and towing vehicles but also machinery vehicles. There is always a loophole or abuse of a tax law. I am anticipating that the Secretary of the Treasury will be issuing guidance soon. Stay tuned for more updates as we receive more information on this credit.

Subscribe to Think Outside The Tax Box to Enjoy:

- Twice monthly newsletter featuring in-depth, easy to understand, exhaustively cited essays on the topic of tax reduction, written by some of the most widely recognized and respected tax professionals in the country.

- Twice monthly email “Around the Tax World” news blog.

- Downloadable infographics and “client alerts”

- Active private Facebook Community

- Hours of recorded tax education videos for Annual subscribers.

- Quarterly live webinar events featuring some of the finest educators within the tax community with included Continuing Education credits.

[1] § 45W

[2] Run with Us to an Electric Tomorrow, https://www.deere.com/en/electric-equipment/.

[3] Interstate Heavy Equipment, https://interstateheavyequipment.com/combine-harvesters-weight/.

[4] John Deere S690 Specifications and Pricing Information, https://www.machinio.com/models/john-deere/s690#results.

[5] § 45W(b)(1)(A).

[6] Hyundai Xcient Gallery, https://trucknbus.hyundai.com/global/en/products/truck/xcient.

[7] § 45W(b)(4)(A).

[8] § 45W(b)(4)(A).

[9] § 45W(b)(4)(B).

[10] § 45W(a)(1)(A).

[11] § 45W(b)(1)(B).

[12] § 45W(b)(1)(A).

[13] Shop Ford, https://shop.ford.com/configure/f150-lightning/model/customize/lariat.

[14] How Much Does The F150 Lightning Weigh? https://gearandcylinder.com/how-much-does-the-f150-lightning-weigh-more-than-youd-expect/.

[15] § 45W(b)(4)(A).

[16] § 45W(a).

[17] Shop Ford, https://shop.ford.com/inventory/f150/details/1FTFW1E81PFA06460?zipcode=40218&ownerPACode=05702&year=2023&intcmp=moddetails-liyml-default-f-150.

[18] § 45W(b)(4)(A).

[19] §45W(d)(3).