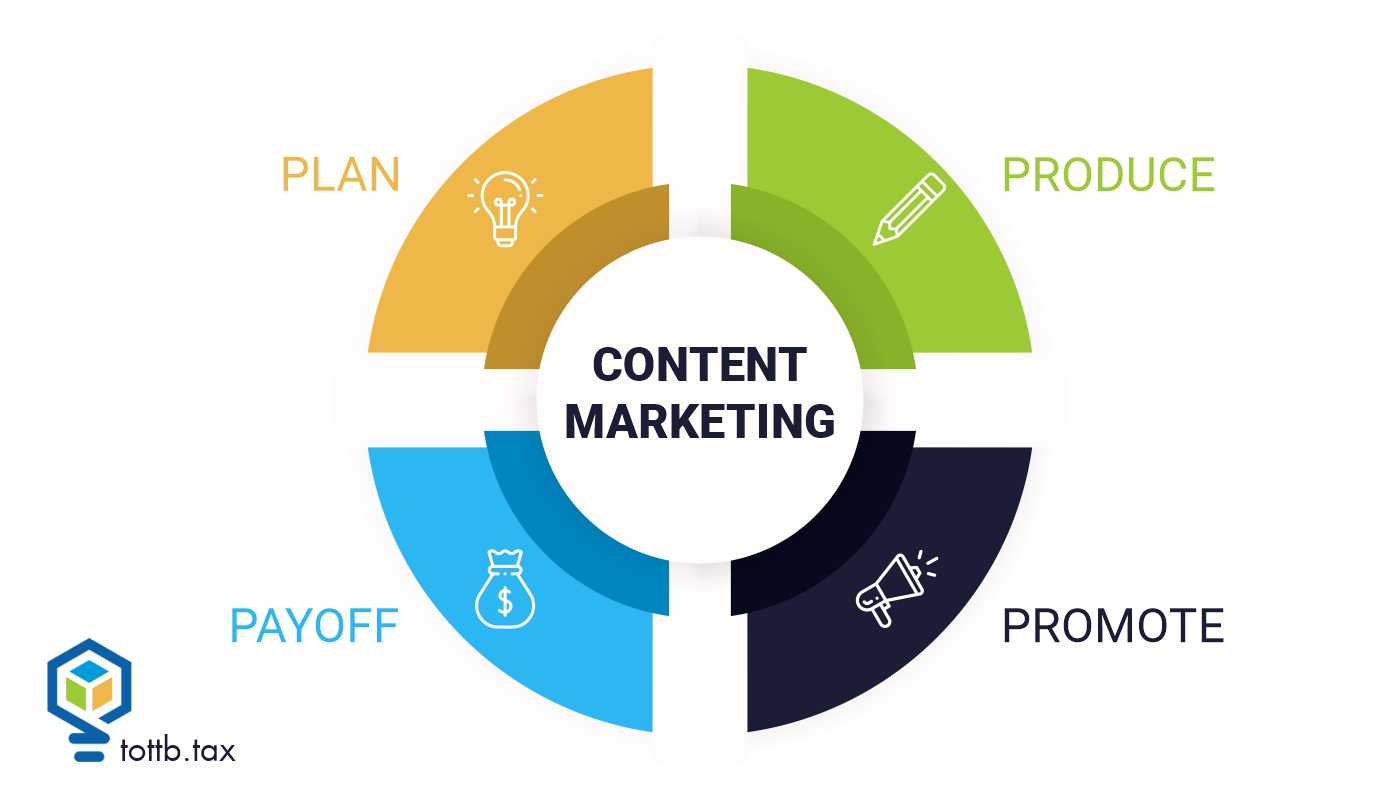

If you read my article Building a Strong Personal Brand as an Accountant: Strategies for Success you’d have learned about how I started my entrepreneurial journey in 2018, knowing absolutely nothing about marketing. I was one of those CFOs who would need to understand why a company has to spend more money on marketing; however, I did understand that having a robust online presence was necessary for a new digital age. Little did I know that marketing is senior to any other activity in a business.

Qualified Opportunity Zones After the One Big Beautiful Bill Act: What’s Changed and What It Means for Real Estate Investors

On July 4, 2025, the One Big Beautiful Bill Act (OBBBA) became law, representing the most significant reform of the QOZ program since its inception. It made the program permanent, tightened eligibility rules, introduced a rural-focused investment vehicle, and imposed robust reporting requirements. For tax professionals and investors, understanding these changes isn’t just about compliance – it’s also about strategy.