BEYOND THE RETURNS:

Managing the Hassles of the Modern Tax Practice

Tax season is always demanding. But what comes after? As a dedicated tax professional, it’s crucial to continually enhance your practice and adapt to an ever-changing landscape.

Introducing the Beyond the Returns Series – an in-depth suite of four live webinars designed to transform your firm’s future.

Key Highlights:

- Navigate the complexities of practice mechanics.

- Achieve a fulfilling balance between home and work.

- Dive deep into the imperatives of security and liability.

- Strategize your firm’s life cycle, from inception to retirement.

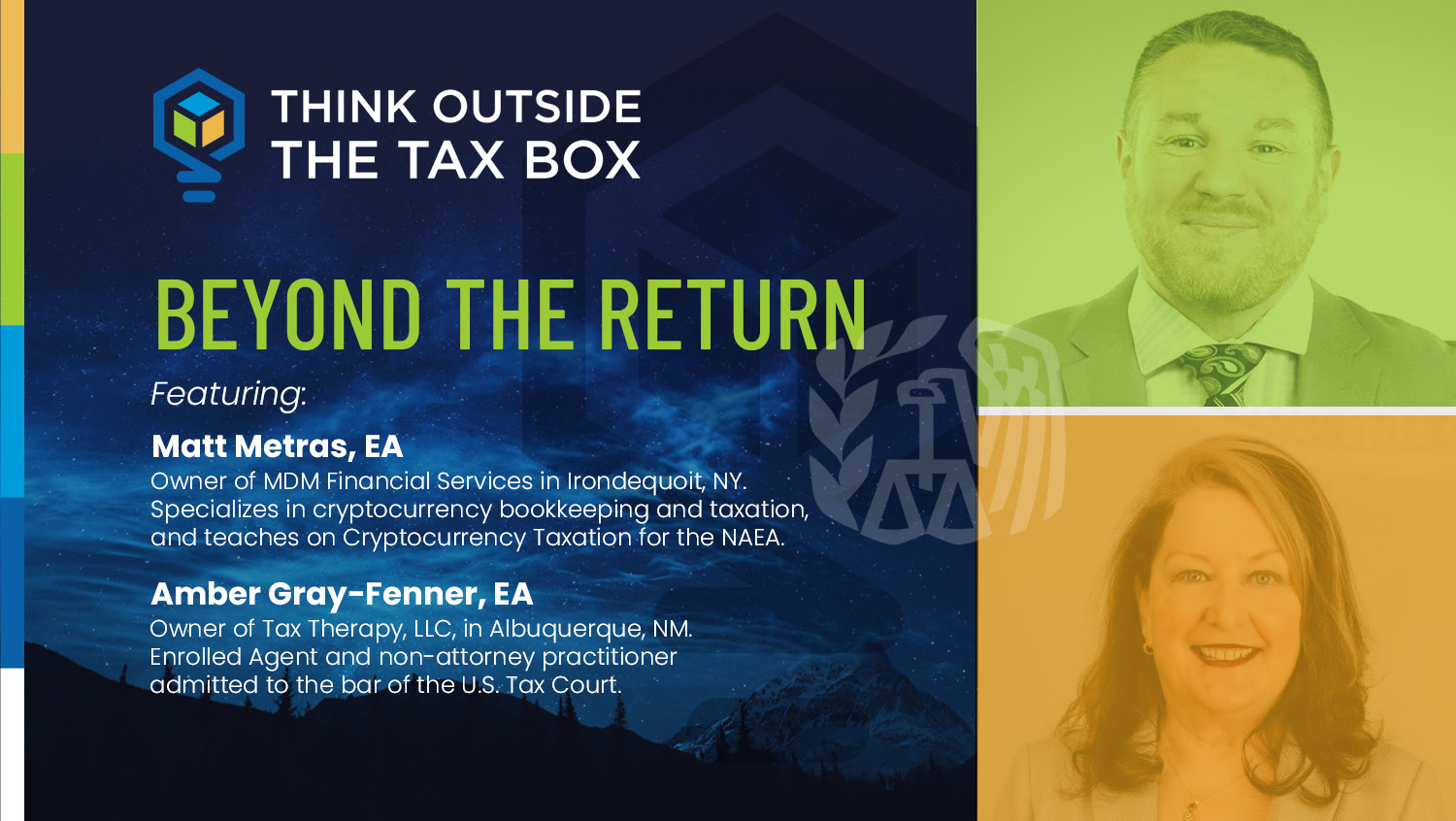

Led by industry veterans, Amber Gray-Fenner, EA, NTPI Fellow, USTCP and Matt Metras, EA, this series promises actionable insights to ensure you’re well-prepared for the 2024 filing season and the years to come.

Don’t miss out on this opportunity to redefine and rejuvenate your tax practice.

BEYOND THE RETURNS: Practice Mechanics

October 24th from 11am PST to 1pm PST

Speakers: Amber Gray-Fenner & Matt Metras

When to Register: Look for the first registration email Thursday, October 5th!

The Backbone of a Successful Tax Practice: Streamlining Mechanics and Client Relations.

Dive deep into the foundational elements that constitute a robust tax practice. From selecting the perfect revenue streams tailored for your expertise to crafting an efficient technology portfolio, this session ensures you’re equipped for the long haul. Amber Gray-Fenner and Matt Metras also shed light on the perennial dilemma: to staff or not to staff? Conclude by exploring strategies to manage client expectations, ensuring a harmonious and lasting professional relationship.

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our Sponsors!

BEYOND THE RETURNS: Boundaries and Balance

November 9th from 11am PST to 1pm PST

Speakers: Amber Gray-Fenner & Matt Metras

When to Register: Look for the first registration email Thursday, October 5th!

Crafting Your Ideal Practice: Balance, Boundaries, and Saying ‘No.

How often have you felt stretched too thin between professional obligations and personal commitments? This session is dedicated to helping you delineate a clear boundary between work and home, allowing for a fulfilling life on both fronts. Understand the essence of defining your ideal client and practice and discover the art of graceful refusal when faced with unsuitable projects. Embrace a holistic approach that aligns with both your professional vision and personal well-being.

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our Sponsors!

BEYOND THE RETURNS: Security and Liability

November 21st from 11am PST to 1pm PST

Speakers: Amber Gray-Fenner & Matt Metras

When to Register: Look for the first registration email Thursday, October 5th!

Beyond Cybersecurity: A Comprehensive Guide to Protecting Your Tax Practice

In an era where data breaches are rampant, it’s imperative for tax professionals to be vigilant about security. This session goes beyond the basics, touching upon the potential pitfalls and challenges of a home office, hiring outside staff, and even attending tax conferences. With guidance from Amber and Matt, delve into the trifecta of security types and arm yourself with the knowledge to mitigate risks, safeguard your practice, and uphold your reputation.

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our Sponsors!

BEYOND THE RETURNS: Business Life Cycles

December 5th from 11am PST to 1pm PST

Speakers: Amber Gray-Fenner & Matt Metras

When to Register: Look for the first registration email Thursday, October 5th!

Evolving with Time: Guiding Your Tax Practice Through Its Life Stages

Every firm has its life cycle, from its spirited beginnings to periods of growth, maintenance, and even impending retirement. In this essential session, join Matt and Amber as they navigate the waters of change. Learn how to initiate with a clear end vision yet remain agile to adapt when unforeseen shifts occur. Whether you’re eyeing growth or contemplating retirement, equip yourself with strategies to seamlessly transition through each phase, ensuring sustained success.

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our Sponsors!1a

SPONSORED EVENTS

The Tax Tango

October 19th from 11am PST to 12pm PST

Speakers: Cal Winch brought to us by American Revitalization Company

When to Register: Look for the first registration email Thursday, October 5th!

Join us as we delve into the ever-evolving landscape of 170(h) deductions for Conservation and Historical Easements, examining the history and impact of Code Section 170(h), a bipartisan legislation enacted over four decades ago. While it provides for qualified charitable contribution deductions for these easements, recent changes, such as the “Conservation Easement Program Integrity Act” of December 2022, have significantly modified the law. Key discussions revolve around the history of this space including the enforcement actions by the IRS and the current legislative landscape. We will focus most of the session on the Historic Preservation Easements in light of the recent legislative protections afforded by the “Conservation Easement Program Integrity Act”. We will also look at actionable planning opportunities for tax advisers and their clients that would utilize the current legislation. Finally, during the Q&A session, Steve will offer some advanced strategies that tax advisors and their clients could use in conjunction with other proven strategies like 1031 exchanges and opportunity zones.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of American Revitalization Company!

Charitable Land Donations

November 2nd from 11am PST to 12pm PST

Speakers: David Johnson and Nick Dolya brought to us by Sandy Bay Partners

When to Register: Look for the first registration email Thursday, October 5th!

As the tax season approaches, we at Sandy Bay Partners would like to draw your attention to the benefits of charitable land donations (“CLDs”) for our investors.

Charitable land donations can be an excellent way for individuals and businesses to support charitable causes while also benefiting from related tax deductions. By investing in a partnership that will be donating land to a charitable organization, our investors can make a positive impact on their communities while receiving meaningful tax benefits.

We understand that navigating the tax laws around charitable land donations can be complex, which is why we are here to help. Our team at Sandy Bay Partners has extensive experience working with investors to maximize the tax benefits of charitable donations, including land donations.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Sandy Bay Partners!

Using Solar Credits to Assist Accredited Clients with Passive Tax Liabilities

November 16th from 11am PST to 12pm PST

Speakers: Chase Ravsten brought to us by Vistia

When to Register: Look for the first registration email Thursday, October 5th!

Solar investment that allows investors with ordinary passive income to invest in renewable energy, while receiving tax credits and depreciation benefits to provide immediate return on their investment. A benefit once reserved for Fortune 500 Companies, and more recently Family Offices & UHNW Individuals, is now more accessible.

Passive income is income generated from an activity or business without your material participation, i.e., at least 500 hours worked. W-2 income is not applicable to this investment opportunity. K-1’s and some 1099’s are applicable.

We will walk you through how to help identify passive income and how you can use solar investments to reduce the tax burden. This will give you the ability as a tax planner to help your clients keep items as passive income and give you another great tool to do tax planning.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Vistia!

IN A NUTSHELL…

WHEN IS IT ALL HAPPENING: Live Webinar Events on Oct. 19th, Oct. 24th, Nov. 2nd, Nov. 9th, Nov. 16th, Nov. 21st, and Dec. 5th!

HOW TO REGISTER: Make sure you are a subscriber and look for the email invitation on Thursday, October 5th with a few reminders to follow!

WHY: To help redefine and rejuvenate your tax practice!

WHO: Amber Gray-Fenner, Matt Metras, and our valued Sponsors.

WHAT: A winter series of live webinar events!

WHERE: Zoom!

YOU SHOULD KNOW: This series will not be available for replay so don’t miss out!