Summer is here and while the kids might be relaxing their minds, now is the time for all good tax professionals to get serious about their education.

Think Outside the Tax Box along with our friends at Sandy Bay Partners is here to help!

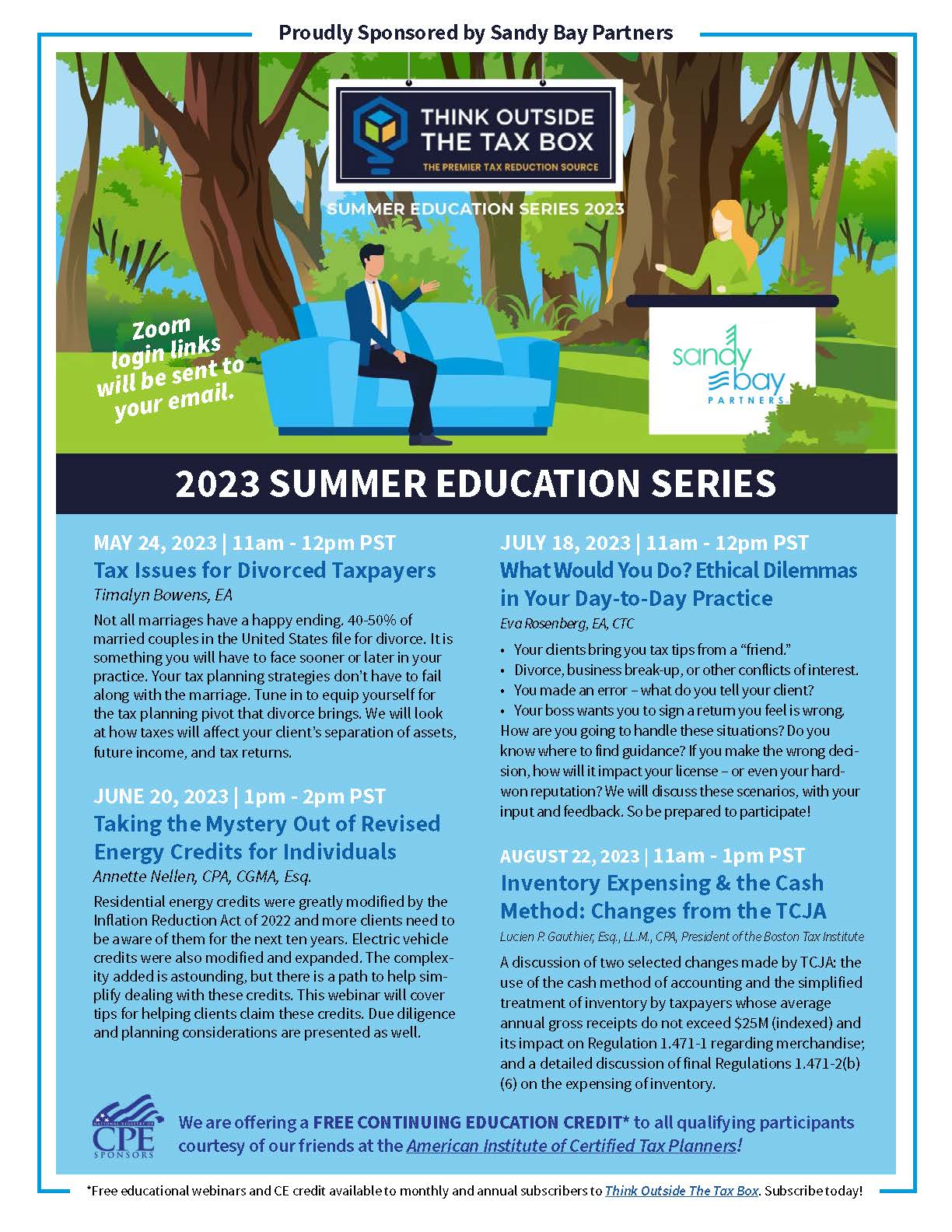

We are thrilled to announce the 2023 Summer Education Series! All summer long we will be bringing our loyal subscribers monthly webinars featuring some of the brightest minds in tax! Each webinar will feature our usual blend of high-quality education and entertainment and include continuing education credits for those who qualify. All of this is included in a regular subscription! Here’s what we have in store for you…

TAX ISSUES FOR DIVORCED TAXPAYERS

MAY 24th from 11am PST to 12pm PST

Speakers: Timalyn Bowens, EA

When to Register: Look for the first registration email Thursday, May 11th!

Not all marriages have a happy ending. 40-50% of married couples in the United States file for divorce. It is something you will have to face sooner or later in your practice. Your tax planning strategies don’t have to fail along with the marriage. Tune in to equip yourself for the tax planning pivot that divorce brings. We will look at how taxes will affect your client’s separation of assets, future income, and tax returns.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Sandy Bay Partners!

UNLOCKING YOUR FIRM’S POTENTIAL: A Guide to Your Digital Transformation

JUNE 8th from 11am PST to 12pm PST

Speakers: Edgar Espinoza sponsored by TaxDome.com

When to Register: Look for the first registration email 5/30/23!

Revolutionize your accounting business and deliver greater value to your clients by automating your daily tasks!

By shifting to a fully online and remote model, tax and accounting professionals can reduce overhead costs, improve agility and responsiveness, and deliver a better customer experience.

Come and learn strategies for transitioning traditional business operations to online platforms, including digitalization of paperwork, cloud migration and workflow automation.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at TaxDome.com!

TAKING THE MYSTERY OUT OF REVISED ENERGY CREDITS FOR INDIVIDUALS

JUNE 20th from 1pm PST to 2pm PST

Speakers: Annette Nellen, CPA, CGMA, Esq.

When to Register: Look for the registration email on 6/13/23!

Residential energy credits were greatly modified by the Inflation Reduction Act of 2022 and more clients need to be aware of them for the next ten years. Electric vehicle credits were also modified and expanded. The complexity added is astounding, but there is a path to help simplify dealing with these credits. This webinar will cover tips for helping clients claim these credits. Due diligence and planning considerations are presented as well.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Sandy Bay Partners!

WHAT WOULD YOU DO? Ethical Dilemmas in Your Day-To-Day Practice

JULY 18th from 11am PST to 12pm PST

Speaker: The TaxMama®, Eva Rosenberg

When to Register: Look for the registration email on 7/6/23!

These are just a few common situations that tax practitioners experience in a day-to-day practice.

- Your clients come to you with advice and tips they got from a “friend”; or “my friend’s CPA” says; or I heard this while standing in line at the grocery checkout counter (yes, even that); or…they read it online. Sometimes, they are convinced that this nonsensical advice is true.

- In some cases, you find yourself in the middle of a divorce, business break-up, or other conflicts of interest.

- Sometimes, you even find that you made an error – what do you tell your client?

- You have a job, and your boss wants you to take a position on a tax return that you feel is wrong – and even wants you to be signing that return.

How are you going to handle these situations? Do you know where to find guidance to give you the tools to make sound decisions? If you make the wrong decision, how will it impact your license – or even your hard-won reputation?

In this webinar, we will discuss this, with your input and feedback. So be prepared to participate!

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Sandy Bay Partners!

MAXIMIZING TAX BENEFITS THROUGH CHARITABLE LAND DONATIONS: A Guide for the Tax Planning Community

AUGUST 8th from 12pm PST to 1pm PST

Speaker: David Johnson and Nick Dolya sponsored by our friends at Sandy Bay Partners!

When to Register: Look for the registration email on 7/27/23!

Join our webinar on Charitable Land Donations to gain insights on how to help your clients maximize their tax benefits and make a positive impact in communities through strategic land donations.

As the tax season approaches, we at Sandy Bay Partners would like to draw your attention to the benefits of charitable land donations (“CLDs”) for our investors.

Charitable land donations can be an excellent way for individuals and businesses to support charitable causes while also benefiting from related tax deductions. By investing in a partnership that will be donating land to a charitable organization, our investors can make a positive impact on their communities while receiving meaningful tax benefits.

We understand that navigating the tax laws around charitable land donations can be complex, which is why we are here to help. Our team at Sandy Bay Partners has extensive experience working with investors to maximize the tax benefits of charitable donations, including land donations.

Learn more about our investment opportunities and how we can assist your investors with their charitable land donations. Thank you for considering our firm for your investors’ tax needs.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Sandy Bay Partners! For special offers and more information on how Sandy Bay Partners can help you, visit them today!

INVENTORY EXPENSING AND THE CASH METHOD: Changes from the TCJA

AUGUST 22nd from 11am PST to 1pm PST

Speaker: Lucien P. Gauthier, Esq., LL.M., CPA, Founder of the Boston Tax Institute

When to Register: Look for the registration email on 8/10/23!

Topics consist of a discussion of two selected changes made by TCJA: the use of the cash method of accounting and the simplified treatment of inventory by taxpayers whose average annual gross receipts do not exceed $25M (indexed) and its impact on Regulation 1.471-1 regarding merchandise; and a detailed discussion of final Regulations 1.471-2(b)(6) on the expensing of inventory.

IN A NUTSHELL…

WHEN IS IT ALL HAPPENING: Live Webinar Events on May 24th, June 8th, June 2oth, July 18th, August 8th, and August 22nd!

HOW TO REGISTER: Make sure you are a subscriber and look for the email to our First event on Thursday, May 11th with many more to follow later!

WHY: To help educate and inspire you on all things tax and over-deliver on our promise of high-quality content for all our subscribers!

WHO: A mix of our regular columnists, guest speakers, and valued sponsors.

WHAT: A summer long series of live webinar events!

WHERE: Zoom!

WHAT COULD POSSIBLY MAKE THIS BETTER!?: We’ll be giving away CE credits and fun freebies at every live event!