Summer is on the way and while the kids might be relaxing their minds, now is the time for all good tax professionals to get serious about their education. Think Outside the Tax Box is here to help!

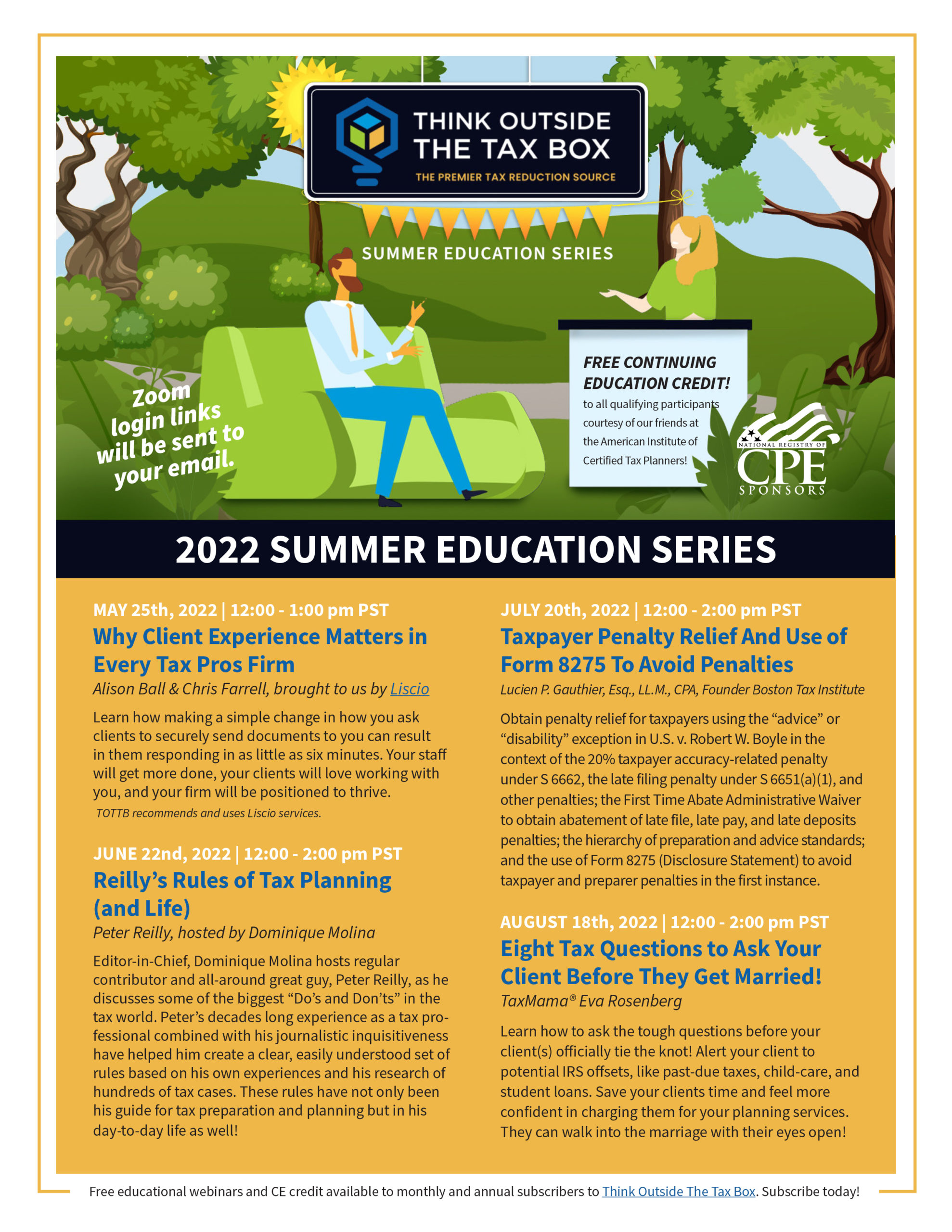

We are incredibly excited to announce the 2022 Think Outside the Tax Box Summer Education Series! Every month through August we will be bringing our subscribers a FREE, live webinar to help educate and inspire on all things tax! As a Monthly or Annual subscriber, these webinars are 100% exclusive and free to join!

WHY CLIENT EXPERIENCE MATTERS IN EVERY TAX PROS FIRM

MAY 25th from 12pm PST to 1pm PST

Speakers: Alison Ball & Timothy Johnson Labarbera brought to us by Liscio

When to Register: Look for the registration email Tuesday, May 10th!

Did you know that Accountants and Tax Professionals waste up to 40% of their time gathering client documents in order to do their work?

In this, our only sponsored live webinar event, come and learn how making a simple change in the way you ask clients to send documents to you can result in them responding in as little as six minutes. Your staff will get more done, your clients will love working with you, and your firm will be positioned to thrive!

This webinar is sponsored by the fine folks at Liscio and is our only sponsored event of the summer series. For more information on Liscio and their products, visit them at LISCIO.

We are offering a FREE CONTINUING EDUCATION CREDIT to all qualifying participants courtesy of our friends at Liscio and the American Institute of Certified Tax Planners!

REILLY’S RULES OF TAX PLANNING (and LIFE!)

JUNE 22nd from 12pm PST to 2pm PST

Speakers: Peter Reilly with Dominique Molina

When to Register: Look for the registration email on 6/6/22!

Editor-in-Chief, Dominique Molina hosts regular contributor and celebrity tax columnist, Peter Reilly, as he discusses some of the biggest “Do’s and Don’ts” in the tax world. Peter’s decades long experience as a tax professional combined with his journalistic inquisitiveness have helped him create a clear, easily understood set of rules based on his own experiences and his research of hundreds of tax cases. These rules have not only been his guide for tax preparation and planning but a guide in his day-to-day life as well!

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our friends at the American Institute of Certified Tax Planners!

TAXPAYER PENALTY RELIEF AND THE USE OF FORM 8275 TO AVOID PENALTIES IN THE FIRST INSTANCE

JULY 20th from 12pm PST to 2pm PST

Speaker: Lucien P. Gauthier, Esq., LL.M., CPA, Founder of the Boston Tax Institute

When to Register: Look for the registration email on 7/7/22!

Think Outside the Tax Box welcomes Lucien P. Gauthier, Esq., LL.M., CPA! Mr. Gauthier has been a practicing tax attorney for over 50 years and is the founder of the Boston Tax Institute.

Topics for this event include a detailed discussion of how to obtain penalty relief for taxpayers using the “advice” exception or the “disability” exception in U.S. v. Robert W. Boyle (Sup. Ct. 01/09/85) as applied in subsequent court decisions such as William O. Harrison, Jr., Estate of Kwang Lee, and Recovery Group, Inc. in the context of the 20% taxpayer accuracy-related penalty under S 6662, the late filing penalty under S 6651(a)(1), and other penalties; the use of the First Time Abate Administrative Waiver to obtain abatement of late file, late pay, and late deposits penalties; the hierarchy of preparation and advice standards; and the use of Form 8275 (Disclosure Statement) to avoid taxpayer and preparer penalties in the first instance.

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our friends at the American Institute of Certified Tax Planners!

EIGHT TAX QUESTIONS TO ASK YOUR CLIENT BEFORE THEY GET MARRIED!

AUGUST 18th from 12pm PST to 2pm PST

Speaker: The TaxMama®, Eva Rosenberg

When to Register: Look for the registration email on 8/5/22!

When two people fall in love, they tend to be blind to life’s realities. The last thing they want to do is bring up issues that might generate conflict, and let’s face it, the topic of taxes is definitely turbulent!

That’s where you, the tax professional, comes in! Learn how to ask the tough questions before your client(s) officially tie the knot! Alert your client to potential IRS offsets, like past-due taxes, child-care, and student loans. Save your clients time and feel more confident in charging them for your planning services. They can walk into the marriage with their eyes open – and they’ll love the value you bring!

We are offering FREE CONTINUING EDUCATION CREDITS to all qualifying participants courtesy of our friends at the American Institute of Certified Tax Planners!

IN A NUTSHELL…

WHEN IS IT ALL HAPPENING: Live Webinar Events on May 25th, June 22nd, July 20th, and August 18th!

HOW TO REGISTER: Make sure you are a subscriber and look for the email to our May event on Tuesday, May 10th with more to follow later!

WHY: To help educate and inspire you on all things tax!

WHO: A mix of our regular columnists and a valued sponsor.

WHAT: A summer long series of live webinar events!

WHERE: Zoom!

WHAT COULD POSSIBLY MAKE THIS BETTER!?: We’ll be giving away CE credits and fun freebies at each event!